Amazon's fourth annual "Prime Day" was a day to forget for major bricks-and-mortar retailers, including Walmart.

Amazon's fourth annual "Prime Day" was a day to forget for major bricks-and-mortar retailers, including Walmart.

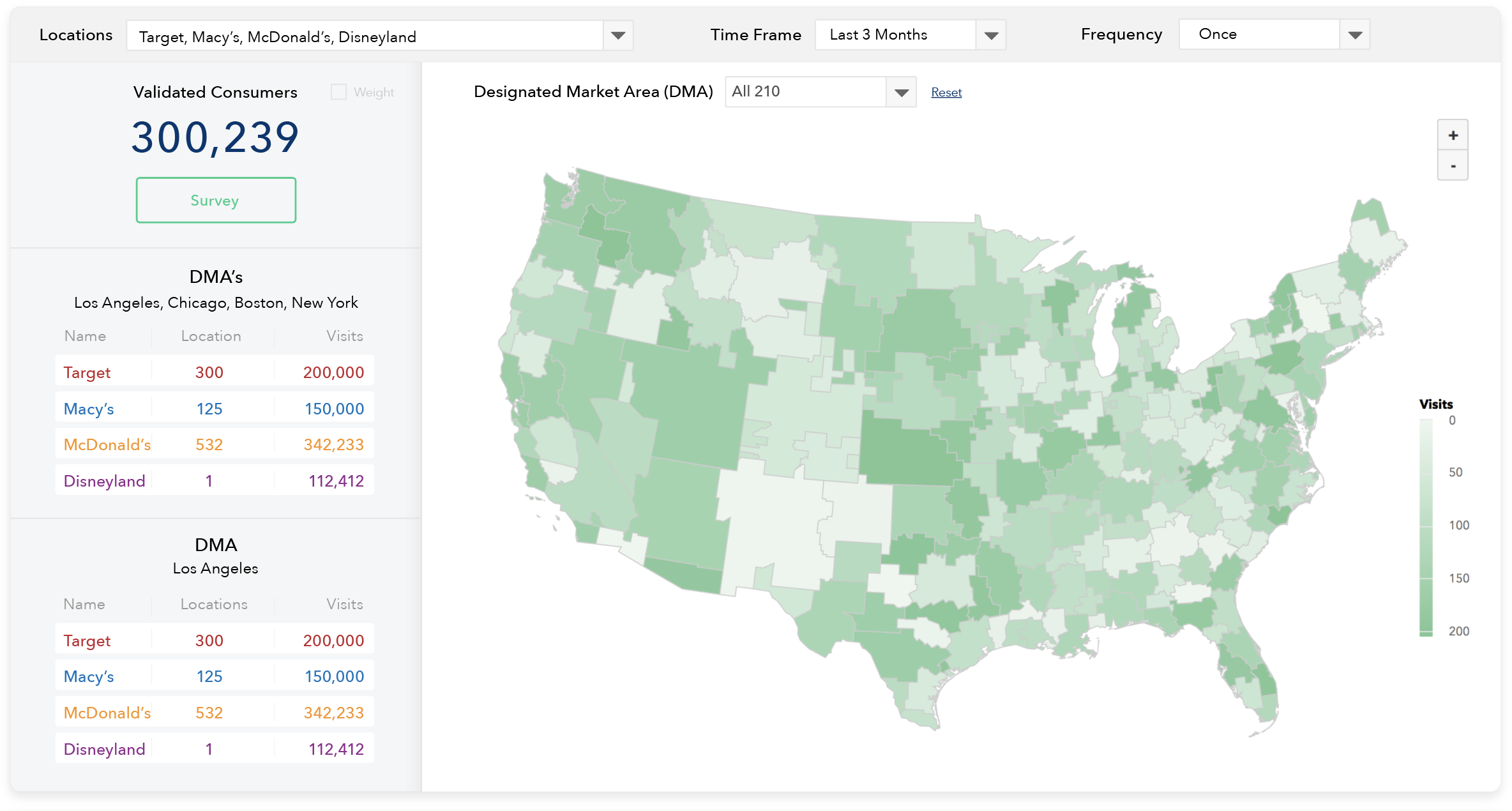

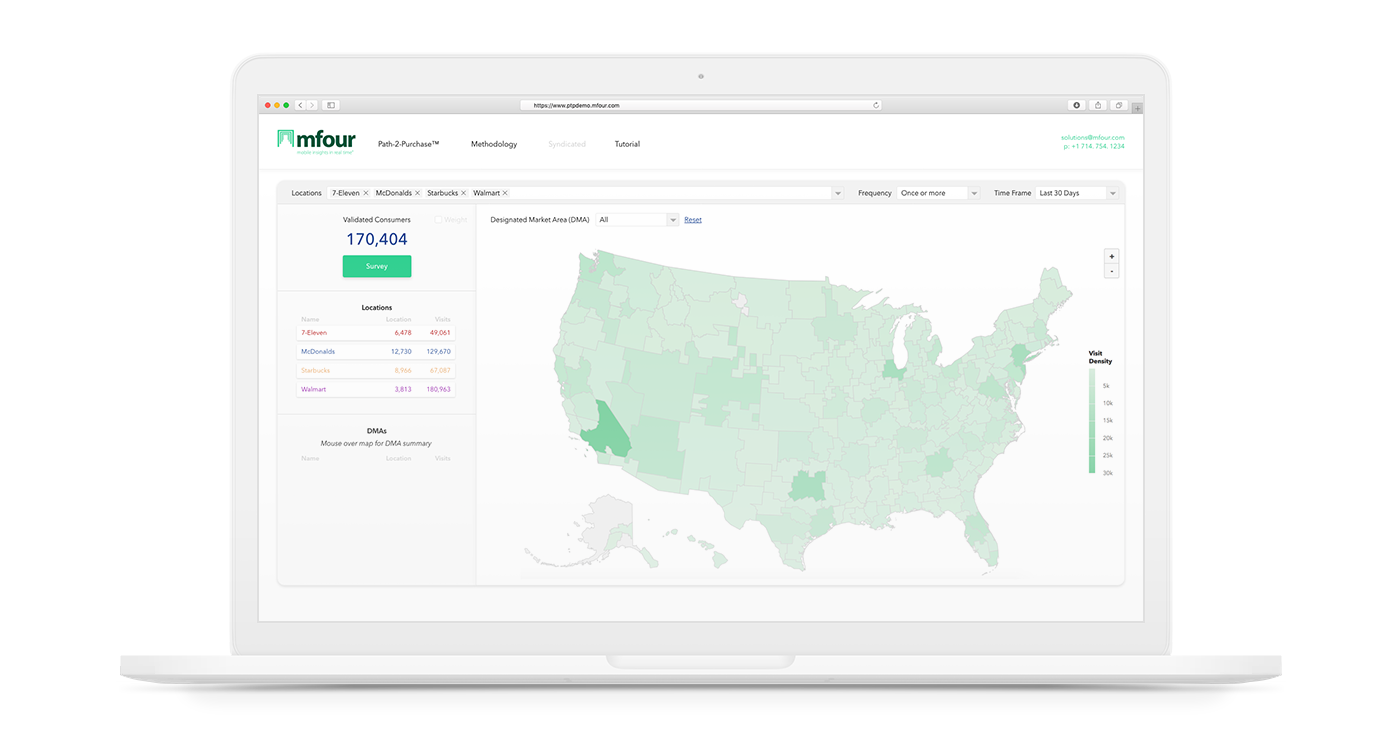

How do we know? All it took was a quick glance at the store-visit data on MFour's Path-2-Purchase™ Platform. There, platform users instantly see customer journeys to all locations of more than 1,000 retailers nationwide.

The data showed that visits to Walmarts sank to 90-day lows on July 16-17 – coinciding with the 36-hour Prime Day promotion in which Amazon Prime members enjoy the biggest discounts of the year. Walmart's foot traffic for Monday, July 16, was 12% lower than its Monday average over the previous three months, excluding the busy Monday of the long Memorial Day weekend.

Whether it's Prime Day or any other day, Path-2-Purchase™ is an unprecedented tool for consumer insights professionals to understand the journeys and motivations of validated, first-party consumers. Its core functions enable researchers to target, track and survey the most relevant consumers, and to append their historical visitation data to provide deep context to any study. Validation is another core value, based on observed location journeys, unique mobile device identifiers, and precise consumer profiles.

Target: to check Prime Day's impact on bricks-and-mortar stores, we did simple targeting based on nationwide visits to a single retailer, Walmart. But Path-2-Purchase™ lets you visualize where consumers go and who they are in granular detail, segmenting by more than 250 demographic and psychographic points and by 12.5 million U.S. locations, including all outposts of the top 1,000 retailers.

Track: consumer-journey tracking options are exhaustive. For example, you can identify and track Walmart's habitual Monday visitors. Track them on the days of their Walmart visits, including where they go just before and after shopping at Walmart. Then see where they go during the same hours on all other days of the week.

Survey: identify loyal Walmart shoppers and ask them whether they used Prime Day to buy products they customarily would shop for at Walmart. Or identify consumers who have the Amazon app for specific insights into their Prime Day spending and experiences.

Append: after taking a snapshot of your relevant consumers' latest actions and attitudes, contextualize by accessing data from a Consumer Knowledge Center that shows where the same research participants have gone in the past.

Validate: No need to ask respondents whether they've shopped at a Walmart in the past 90 days, where, and how often. You already know all of that.

Like Amazon, Path-2-Purchase™ is a platform full of endless possibilities. It's comprehensive, convenient, and efficient. To access the platform for a self-guided demo, just click here. And to set up a live, one-on-one discussion about how Path-2-Purchase™ and MFour's other solutions can fill your projects' specific needs, just click here.