Football season is back (yessss!!), and with it comes a tip for consumer insights pros: one of the key performance indicators for a market research team’s success is how well it can intercept consumers during their natural buying journeys.

In the NFL, interceptions are often game-changers, and it takes a rare combination of talent and skill to intercept. The key attributes are quickness and anticipation, and an uncanny knack for being in just the right position when the ball is in the air.

Quickness and being in the right place at the right time are also crucial to collecting quality consumer data that will give decision-making stakeholders the field position they need to advance their companies’ or brands’ marketing and sales goals.

In theory, retailers can get reliable (albeit seldom timely) data on what’s actually being bought. But they get no real insight into customers' motivations – the "why" behind the "what." The problem becomes exponentially harder when the subject is non-buying behavior. Who entered a store but failed to buy everything they’d intended to purchase? What did they not buy? Why did it happen, and how much revenue did the store leave on the table?

The answers, and the ability to defend against non-buying, won’t be forthcoming unless customer experience research teams learn how to intercept.

There’s no better way to collect premium data than by intercepting it from consumers naturally, and in real time, as they go about their daily buying journeys. So in the spirit of NFL players poring over game film to get a competitive edge, let’s look at a case study that illustrates how natural intercepts work.

The Problem: Researchers for a leading retail chain that does a huge volume in CPG sales were trying to tackle one of their business’s most frustrating problems: losing revenue because many customers who entered a store didn't buy everything they had intended to purchase.

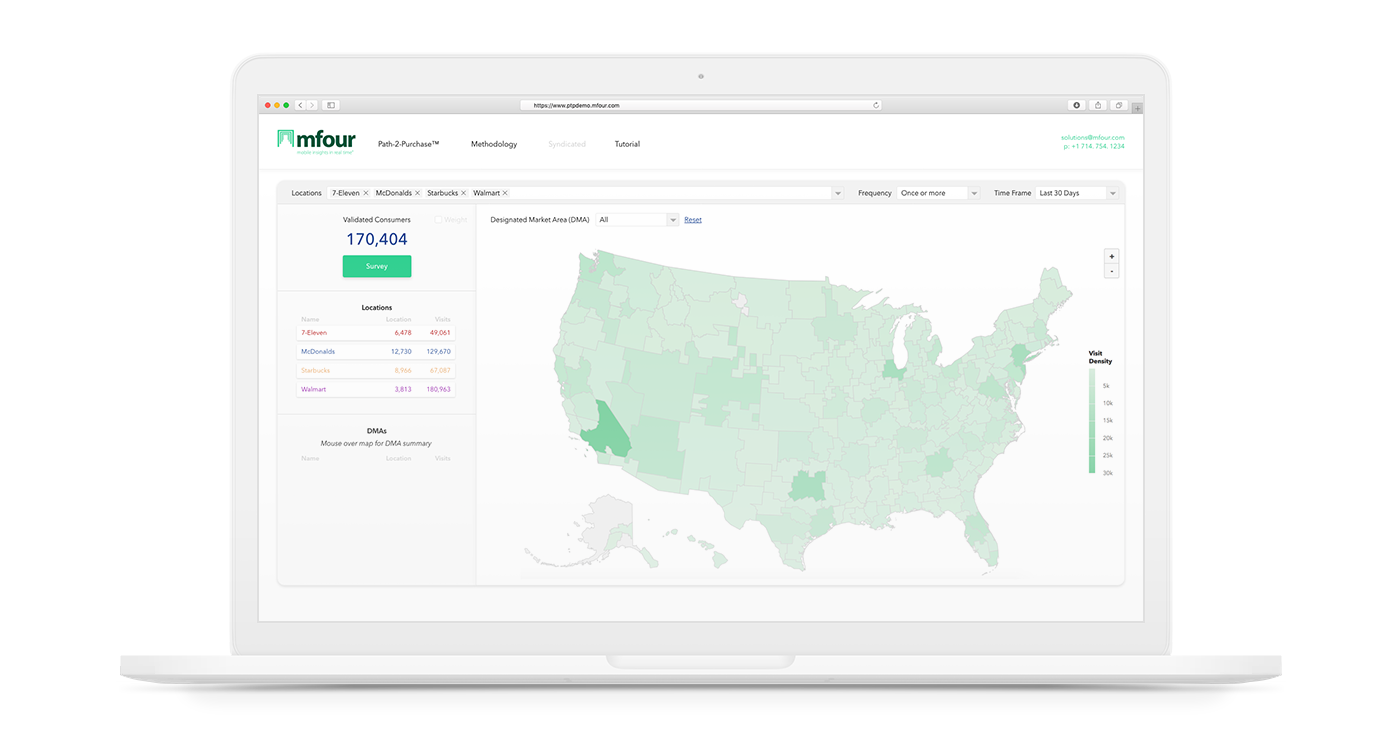

The Answer: For the retail chain in question, all it took was a discussion with MFour reps about GeoValidation® – a proprietary capability driven by the advanced GPS technology embedded in the Surveys on the Go® research app. Clients track app-using U.S. consumers’ movements and verify when they arrive and then leave a location of research interest.

- In this case, all members of MFour’s first-party consumer panel who entered one of the client’s stores were located on arrival, and received a push notification of a survey opportunity upon departure.

- When they responded – with a 25% response rate within an hour and 50% within 24 hours – the process of intercept followed by data return was complete.

- Qualifiers for the study were 400 consumers nationwide, who said they had not purchased everything they had intended to buy.

- In beauty products, 31% of non-purchasers cited price as the factor that discouraged them from buying; 37% said they had simply been unable to find the item they wanted, or that it was not available.

- For shoppers looking for personal care products, 31% cited price and 28% cited unavailability or inability to find the intended item.

- Among candy and snack intenders, 20% said they didn’t buy because of pricing, and 24% because what they wanted wasn’t there or couldn’t be found.

- Among grocery and beverage shoppers who said they had left without an item they had arrived intending to purchase, 44% cited price and 24% said items were not available or couldn’t be found.

- Asked whether they were satisfied with their overall shopping experience, 57% of non-buyers rated their visit as an 8 or a 9 on a nine-point satisfaction scale. 24% graded their experience in the poor to middling range (1 to 6 on the scale).

The study gave the client clarity on factors that were costing it millions in revenue each day nationwide, and potentially alienating many customers. The previously unobtainable data from natural intercepts gave researchers their first clearly-informed look at the problem, so they could recommend a game plan to win back the sales and revenue that the chain’s stores were letting slide through their hands.

For an informative and productive conversation about how to program natural intercepts into your research game plan, just click here.