It's decision time for your stakeholders.

The nation's largest first-party panel, Surveys On The Go®, showed U.S. foot traffic had already dropped 92%; even before lockdowns started.

Consumers are in quarantine. Budgets are cut. Production is halted. So, what’s next, and how do we stay afloat?

You have questions. Here are answers...

After speaking with 100’s of our clients since March 11th, we found a pattern in our conversations... 3 questions... asked over and over. We wanted to help, so...

Here is our effort to answer them.

Top Covid-19 Research Question #1:

How do we get digital insights from consumers... right now?

California, New York, and Illinois are already on lockdown.

This throws a wrench into many traditional forms of market research.

Yet, consumers haven't stopped spending. They’ve shifted their focus online and to apps that allow them to still buy, such as Amazon, UberEats, Netflix and more.

Now is the time to be looking at consumers’ digital path to purchase, so you can impact sales and improve revenue.

Answer: Survey consumers who shop with you (or your competitors) digitally.

We know your consumers' app behaviors.

Here’s how.

Surveys On The Go, can see all of the apps on consumers' phones. It's given permission, by the people who download it, to do so. When they download a new app, or access one, you'll have access to see their digital data.

This helps your company remain digitally connected. For example... If you’re in the restaurant space, you can reach out to your consumers who have:

- The UberEats or GrubHub app installed on their phone

- Recently been to your restaurant or a competitor's restaurant

You can then survey on a variety of things. Ask questions to improve channels, messaging, and product strategy for the digital path to purchase. It's still possible to access sales, if the business can be nimble and adapt to a more digital model.

Learn how to get digital event surveys.

Top Covid-19 Research Question #2:

How do we protect sales, with consumers stuck at home?

Your business has likely felt an impact.

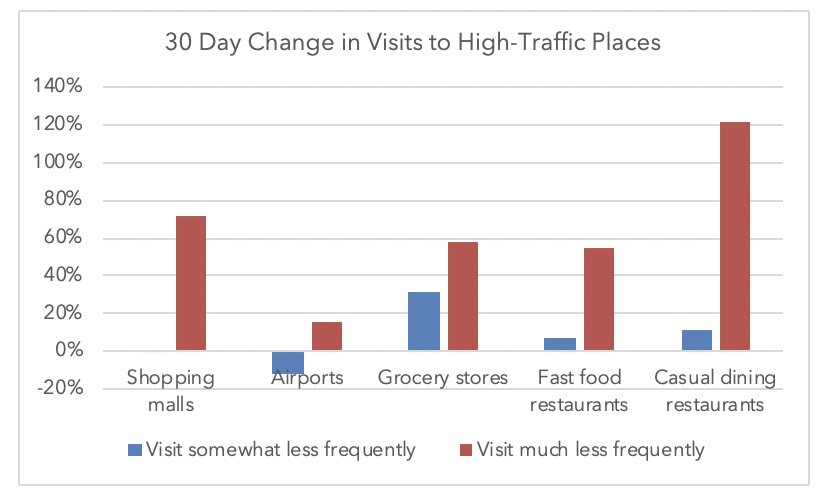

Regardless of what you produce, the economic climate has changed. The result has been the split of two main categories:

- Essentials, such as household supplies are up in sales.

- Non-Essentials, such as casual dining are down in sales.

It’s left researchers with questions, such as:

- Will these trends continue?

- For how long, and how much will we be impacted?

- How can we increase sales under these circumstances?

Answer: Double down on social media ads and social media ad testing.

Consumers are spending more time on their smartphones than before the outbreak. Online shopping is up 46% (in categories such as clothing and home decor), but the biggest uptick is in time spent on social media platforms.

To reach consumers, and increase sales, try their social streams.

With advertising budgets cut across the nation, the cost of running ads on social media is actually down right now, which makes it a great opportunity.

Since social media is the best way to reach your consumers (for the foreseeable future, at least), it makes sense that you’ll need to test messaging and concepts and get real validated opinions and feedback from your consumers, in real-time.

How social ad testing works...

You can choose your audience from 10 million daily consumer journeys. These are panelists who use Surveys on the Go®, the highest-rated app for market research.

Then, launch and collect passive data on your social media ad. You’ll see:

- Visibility time and reach

- Time spent viewing the ad

- If they liked and/or clicked on it

- Whether they tapped to expand the display

- If they turned on the audio or viewed on mute

After you’ve collected passive behavior, you can do a survey to understand their motivation. Take your target audience through the following questions:

- Do they remember the ad?

- What brands do they recall seeing?

- Is the content likable? distinctive? memorable?

- Does the ad create favorable impressions of your brand and push a purchase?

If the ad’s a hit, then you’ve got a proven, scalable campaign. Or, if it needs to be revised, there's now direct feedback and a way to retest the ad for primetime.

Learn more about social ad testing.

Top Covid-19 Research Question #3:

How can we monitor consumer behavior if it's changing daily?

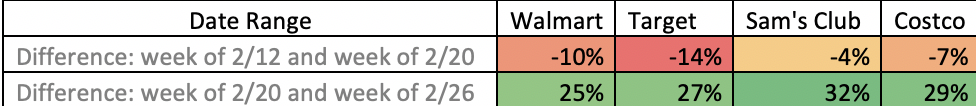

Consumer behavior has changed.

And, it’s evolving, from week to week. Behavior will continue to change as conditions worsen (or better), as different states take certain precautions, and as major competitors change the way they market.

So, how can you monitor behavior, if it’s constantly changing?

Answer: A mobile tracker (that captures location and digital behaviors).

You need a way to keep in touch with your consumers every move.

What you're looking for, is a way to:

- See where consumers are going in real-time

(and compare be able to measure it against historically logged locations) - See what apps consumers are accessing in real-time

(and which apps they have installed and which new ones they’re downloading) - Target and survey based on mixed location or digital behaviors.

In a time like this, visibility is everything.

A mobile tracker looks at consumer behavior over time, and eliminates the noise that comes with constant changes. It shares brand perception, and uses a validated, first-party panel to show your market’s digital behaviors and mobile behaviors.

Learn more about always-on mobile trackers.

Start impacting digital sales

Our market research team is here to brainstorm with you.

If you’re facing a challenge, chances are, we’ve seen it – and can help. We’ve helped the largest brands and market research companies in the world.

Call us at (714) 754-1234, or send us an email: solutions@mfour.com.

We’re here to help.

Start a new market research project