Big-Box retail is up 32%. Restaurants are down 121%.

The economy demands we take Coronavirus seriously.

Here’s why. On March 10, the Dow dropped 1,200 points. This came a day after the World Health Organization (WHO) declared Coronavirus a global pandemic.

So, what does that mean?

Coronavirus is sickening the stock market. And we need to get out ahead of it in order to protect ourselves from a recession. Protect yourself from a rapid decrease in consumer spending. Use research.

Be looking at buying behavior, and how to influence it in your favor.

Consumer spend is dying

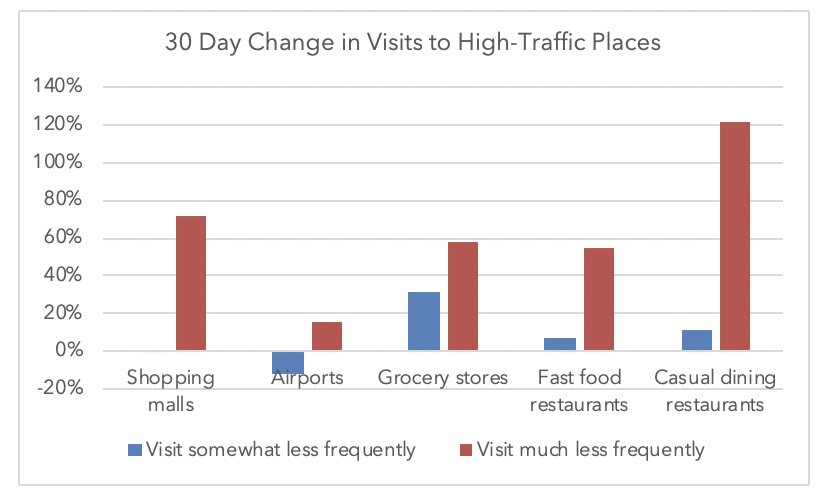

We tracked real consumers for 30 days. In one month, they dramatically decreased shopping and being social. Figure 1 below shows how much they’ve changed due to the virus.

Figure 1: High-Traffic Visits: February vs. March 2020

Figure 1: percent change was used to calculate increase/decrease from February to March waves.

These same people are now limiting time with friends and family by 92% and 74% are working remotely. When consumer spending is 73% of the economy, that’s a big problem.

Are your products sold in-stores?

Focus on what you can control.

If you sell clothing, or home décor, your in-store revenue will shrink.

We saw in-store home décor purchases among our consumer group drop 31%. Clothes fell 32%. But, hope isn’t lost. That same group is now buying online, where there’s a 46% increase in visits. They’re changing behavior: saying “no” to stores, but “yes” to online.

Take advantage of what they’re telling you. They’re still willing to buy, but they want to do it from the perceived safety and comfort of their own home. Act on what they’re asking for.

Do you sell food or home supplies?

Business is doing well here.

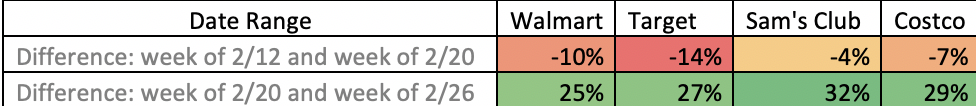

We tracked consumer visits to Walmart, Target, Sam’s Club and Costco using the Surveys On The Go® app. All visits were down in January and most of February. But then, the World Health Organization (WHO) announced Coronavirus is a global pandemic1 the week of February 20th.

An instant jump in Figure 2 below. Consumers are stocking up for a potential quarantine.

Figure 2: Tracked Visits to Big Box Retailers from 1/1/20 to 3/4/20

Figure 2: percent change was used to calculate increase/decrease from week over week from 1/1 through 2/26.

Methodology

Survey sent to 1,133 US consumers, male (48%) and female (52%) aged 18-44 years old. Participants were screened on knowledge of Coronavirus and a retailer visit within 30 days. Percent change was used to calculate increase/decrease from week over week from 1/1 to 2/26. Qualified respondents received a 13-question survey. Location-based behavioral data was collected via the Surveys On The Go® app through GPS permissions, examining with a visit between January 1st and March 4th, 2020.

What they're buying

Immediately, there’s a demand for hand sanitizer (80%), household supplies (65%), nonperishable foods (49%), and face masks (35%).

And because consumers are preparing for two to four weeks, we’re seeing the buying shift at big box retailers, where they can buy in bulk. So, if you’re in the market to sell any of these items, now is the time to pull the levers on your supply chain to make more – and quickly.

What’s next?

No one knows.

Prepare by tracking consumers over time, so you’re not caught off guard. The economic situation is changing quickly. You want to stay ahead of the competition – as well as a potential recession. Take time to think through the questions you need answered, by your consumers, and then ask them.

Research is more important than ever. This is the time to take stock of your market position.

Need help?

We’re researching the impact of COVID-19 now for clients. If you want to know the impact on your marketplace, let’s look at it together. For the full research report, or for assistance, email solutions@mfour.com.

For a Full Copy of the Research Report click here to contact MFour.

References: