The theme music for today’s consumer insights discussion is “Every Breath You Take” by the Police, which was the biggest hit of the year in both the U.S. and the U.K. back in 1983.

“Every move you make, every step you take, I’ll be watching you,” sang the trio’s front man, Sting. He was talking about following a love interest everywhere, to the point of obsession.

We’re talking about following your competitors’ customers everywhere, day by day, week after week and month after month, to gain the competitive intelligence that can help you turn them into your own customers.

How? Not by shadowing them step by step on foot or in a vehicle, but by tracking them remotely and round the clock with complete precision, by leveraging advanced mobile GPS location technology – and much more. Beyond the right technology, you need to track and know the right people – in this case, members of a validated, first-party, all-mobile consumer panel who have given informed consent and opted in twice to allow researchers to track their physical buying journeys in exchange for opportunities to participate in mobile location surveys and earn cash rewards.

- Every move they make across 12.5 million U.S. retail locations is tracked and archived on MFour’s Path-2-Purchase® Platform.

- That includes almost every store of the nation’s top 1,000 retailer chains, amounting to about 750,000 store visits each day.

- Each visit is archived in a Consumer Data Center you can tap into to gain context for observed journeys.

- And every consumer who’s tracked can be surveyed at any time, to gain a clear understanding of what’s motivating his or her observed buying journeys – especially visits to the businesses you’re competing against.

Say, for example, that you’re conducting competitive intelligence research for a convenience store chain, and want to focus on Hispanic American Millennials who have incomes of $50,000 to $75,000.

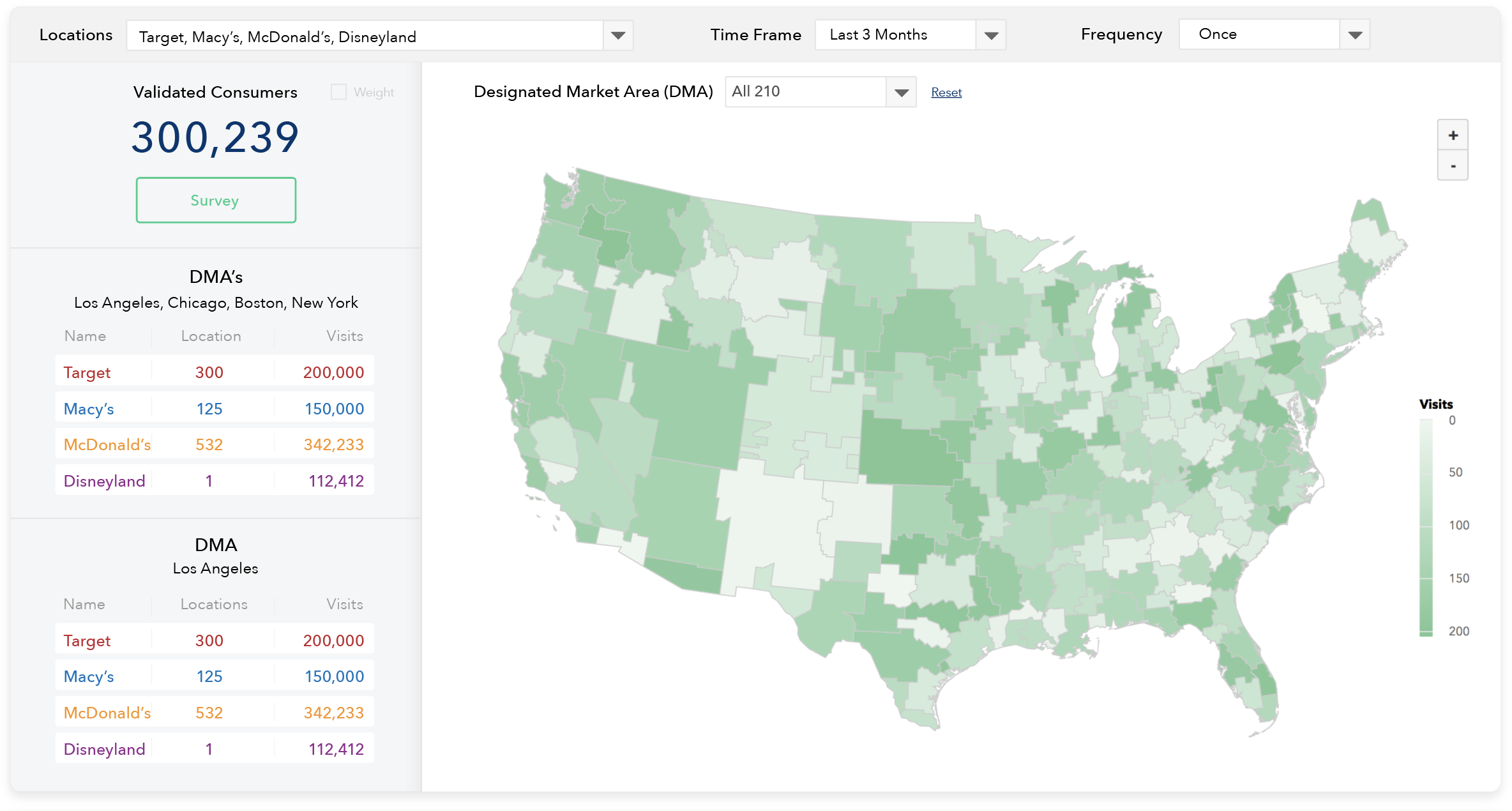

First, you’ll plug in the name of the competing c-store chain(s) whose customers you’re trying to convert.

Then enter the characteristics of the people you want to track — in this case, the above-mentioned ethnicity, age, and income stratum.

The platform automatically shows daily visitation by the targeted group to each competing location, with a graphic visualization comparing it to your own visits on the same day or range of dates. You can see the nationwide competitive picture, or narrow it down to a single DMA. Among the consumer attributes and segments you can study are:

- Brand loyalists: who regularly visits the competing c-store chain, but never comes to one of your own?

- Brand agnostics: who’s going to multiple c-stores, marking them as consumers you can try to win over, if you can understand reasons for their c-store polygamy.

- Frequent shoppers: who goes to c-stores every day, or nearly every day?

- Daypart shoppers: who’s going in the morning, who at lunch time, and who on the way home from work?

- Complete daily journeys: where were c-store shoppers coming from before making that stop? And where did they go next?

Observed location behaviors will tell you a great deal about your competitive landscape, but for the deepest insights you also need to understand the “why.” And for that, there’s no substitute for talking to the same consumers whose buying journeys you’ve been observing. You can send them a notification of a mobile survey opportunity at any time. The ideal solution is to move from location-observation to location surveys. Respondents are detected when they enter your competitors’ stores, and receive a survey notification as soon as they exit. Response rates are typically 25% within an hour and 50% within 24 hours. The incidence rate can be as high as 100%, because you’ll always have certainty that you’re sending surveys to people who’ve are exactly where you need them to be.

- Do your competitors’ loyalists have different motivations than your own loyalists (who you also can identify, observe and survey by using Path-2-Purchase®)?

- Is there some pattern of attitudes, preferences and behaviors that differentiates your competitors’ customers from your own?

- Or are they similar enough to be reachable and changeable, given the right messages or incentives?

- What are the characteristics and motivations of brand-agnostic consumers who ping-pong between different stores? And how might they be susceptible to special offers or specially-targeted advertising?

To sum up, there’s now a tool called Path-2-Purchase® that for the first time lets researchers combine observed location-tracking data with survey data. The data is ultra-reliable because surveys are answered by the same actual consumers whose location journeys you’ve already tracked and observed. The process gives you quality data from real, validated consumers who all take part in your research via Surveys On the Go®, the groundbreaking app that has harnessed the immense capabilities of smartphones for receiving and sending information.

This look at mobile-app location and survey research just skims the surface. For example, we haven’t mentioned how smartphones’ ability to display and transmit photos and videos can bring real-time survey data truly alive and make your reports all the more vivid and impactful.

In competitive intelligence research, every move you make and every step you take should bring you and your decision-makers closer to the goal of prying away customers and market share from your competitors. To learn more about how Path-2-Purchase® and other mobile capabilities can bring more accuracy and intense meaning to your specific projects, just fill out the brief form below.