L-R: Allyson Wehn, Joan Martinez, Andrea Han

Successful market research delivers accurate, actionable numbers that reliably depict consumer reality, but success really depends on the human factor. At one end are the people who provide a window on reality by participating in research as respondents. At the other are the consumer insights professionals who have the expertise and passion to succeed at the meticulous, exacting work of creating studies that will obtain data that's pertinent and reliable, then interpret what it all means to give clients analysis and recommendations that will help them reach smart business decisions.

It's only fitting, then, that three key members of MFour's insights team, Senior Research Consultants Andrea Han, Joan Martinez and Allyson Wehn, have a spotlight moment in the August issue of Quirk's, as part of its "Faces of Market Research" feature. You can check out their profile in the magazine itself by clicking here (see pg. 57). Or just read on.

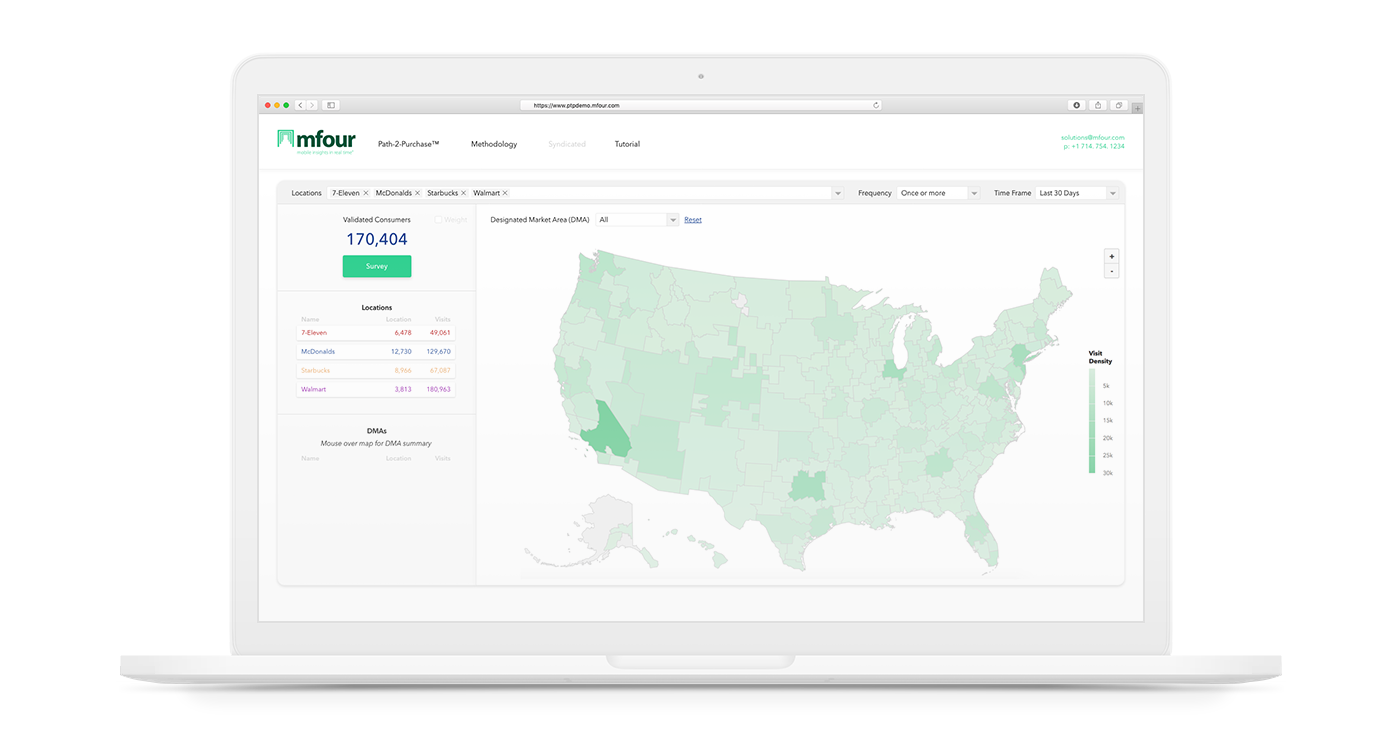

Andrea Han, Joan Martinez and Allyson Wehn have come from widely diverse hometowns – Sao Paulo, Brazil, the village of Ordot on Guam, and Fullerton, CA., respectively -- to share a proud and important job title at MFour: Senior Research Consultant. They also share a passion for consumer insights that, among them, has produced 57 years’ experience in market research. As a team, they analyze data obtained from validated, first-party consumers who participate in research by using MFour’s pioneering mobile app, Surveys on the Go®. That includes drawing insights from location tracking data, photo captures, and real-time “video selfies” that respondents create and submit with their phones.

“My natural curiosity has driven my career,” says Martinez, who has been doing consumer research since her college days at California State University, Los Angeles. “What intrigues me about MFour is the technology. My thinking was, `this is the new frontier, where the world is going.’ I want to be part of that.”

For Wehn, “sometimes I feel like a detective, because clients are asking me to look for answers.” The University of California, Santa Barbara graduate also relishes the populist underpinnings of consumer research. When she’s out shopping, she often finds herself mentally recreating the research behind the merchandise. “When I see the real-life applications, more often than not those decisions come from consumers giving feedback on how they want things to be.”

Han, a graduate of the University of Southern California, says her career satisfaction is tied to her clients’ satisfaction. “They want to know, `what does this data mean to us?’ That’s what we’re here for. The real rewarding part for me is when clients look at the insights in the deck and say, `this is what we needed…and more.’”

You, too, can get what you need...and more. Get in touch and we'll talk about getting you started. Just click here.