This study was a joint effort by Marketcast and MFour Mobile Research leveraging MFour's mobile survey platform. The topic of study was what gamers expect (and want) from digital distribution.

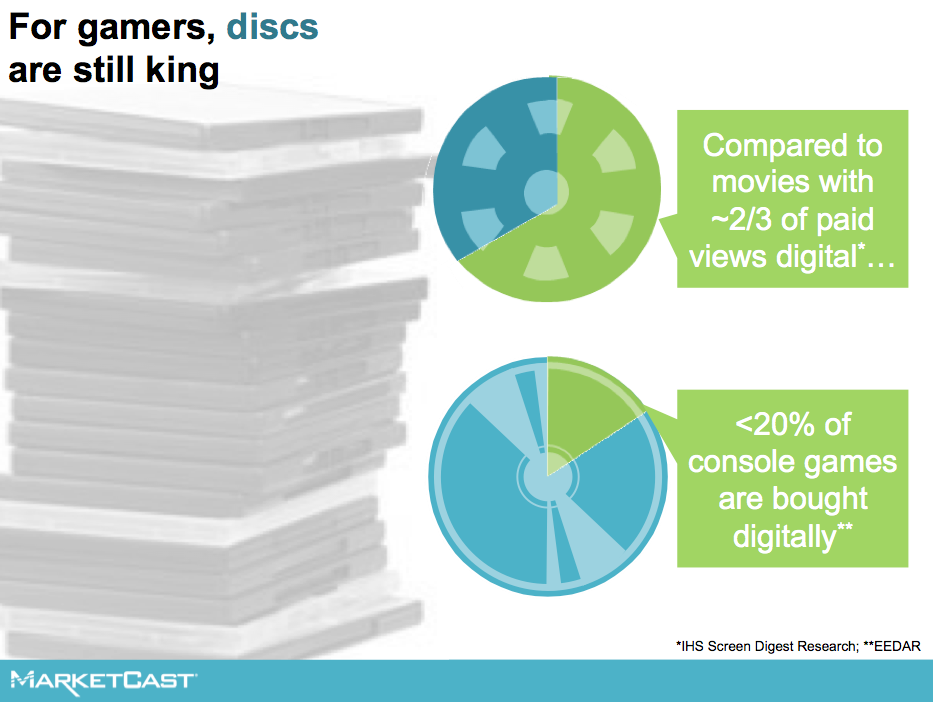

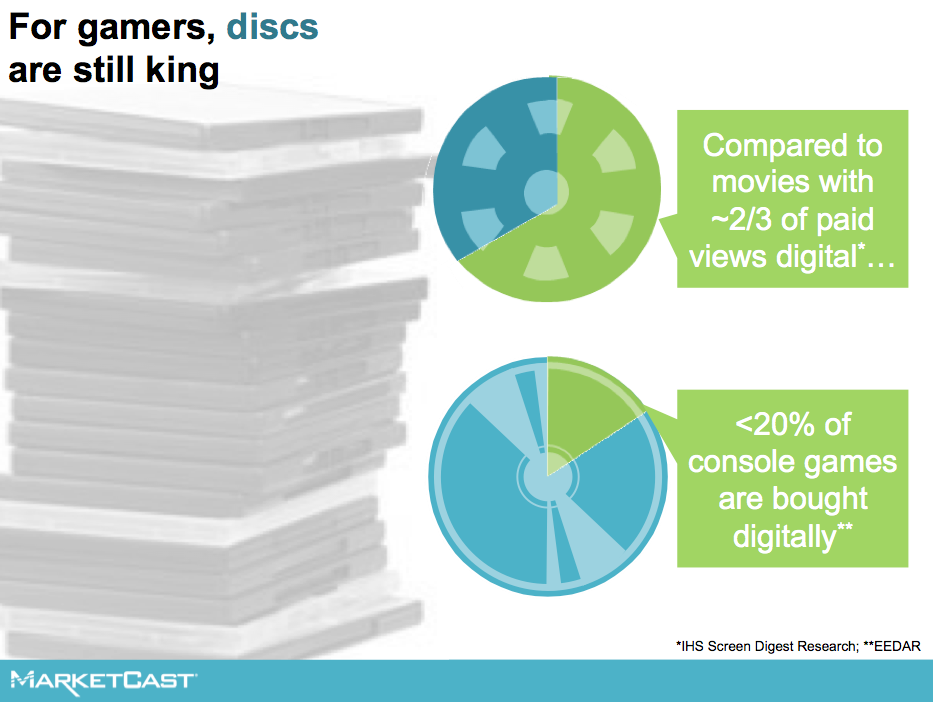

Compared to around 2/3 of movies watched at home that are bought digitally, less than 1 in 5 console games purchased is a digital download. The majority are still bought via traditional physical discs.

Major publishers report that while their digital revenue is growing substantially, full game downloads make up a much smaller portion of this than subscriptions and add-on downloadable content.

Most coverage in the press focuses on the industry impact, and especially on the overall growth of digital revenue, of which game sales are still a small part. Instead, we decided to talk directly to gamers and find out how they feel about the digital shift in gaming compared to other forms of entertainment, and what they want from this shift.

Using MFour's native app, Surveys On The Go, respondents were asked to use their front facing cameras to capture deeper insights. Here is what they had to say:

[video width="144" height="192" mp4="http://mfour.com/wp-content/uploads/2015/02/Vid1Phys-1235049.mp4"][/video]

[video width="144" height="192" mp4="http://mfour.com/wp-content/uploads/2015/02/Vid2B-1272199.mp4"][/video]

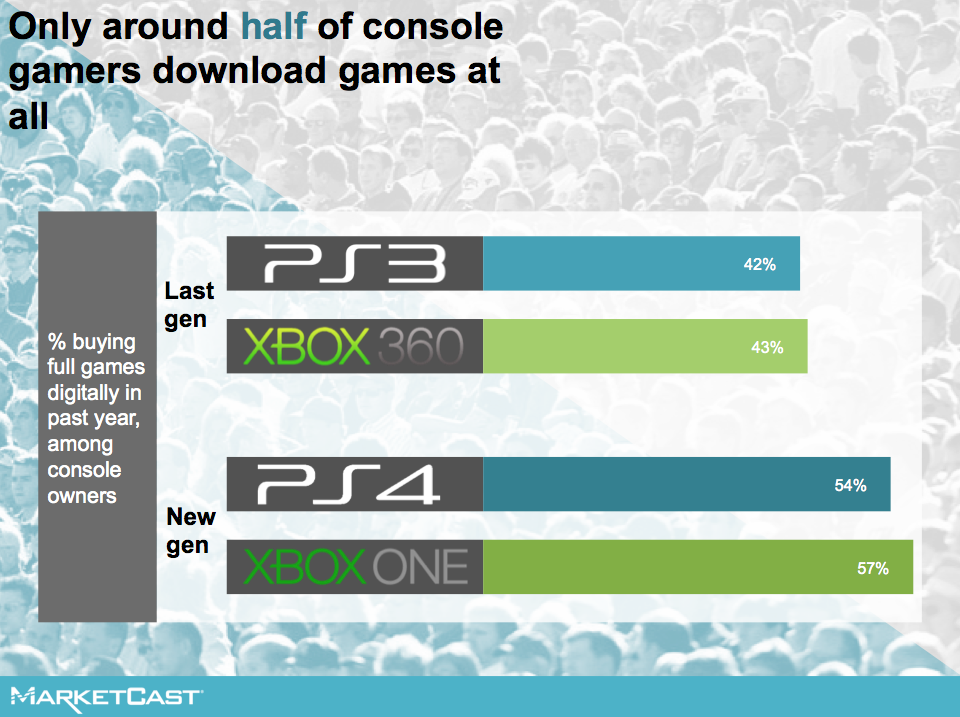

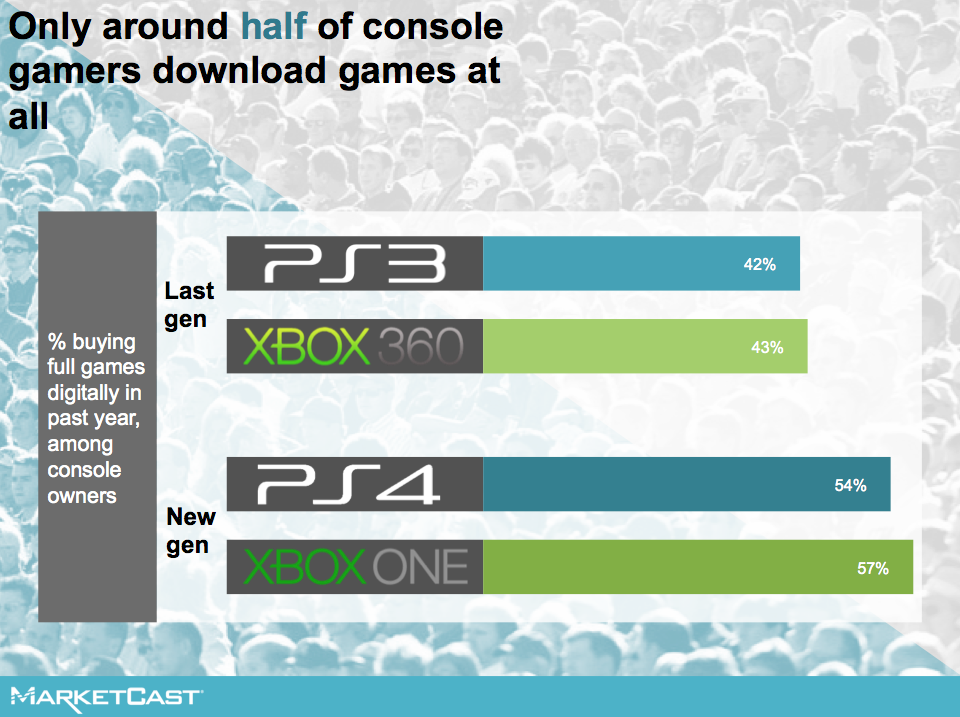

Current-generation console owners are more likely to be buying games digitally than previous-gen gamers, where only 2 in 5 gamers have bought a game digitally in the past year.

Gamers who subscribe to their console’s premium tier – Xbox Live Gold, PlayStation Plus – are also more likely to be buying games digitally than those who just belong to the free tier.

And gamers who play on both console and PC may be accustomed to downloading games on their computers via Steam, but being a regular Steam user doesn’t carry that download-know-how over to console usage; playing games on Steam has no impact on gamers’ willingness to download games on console.

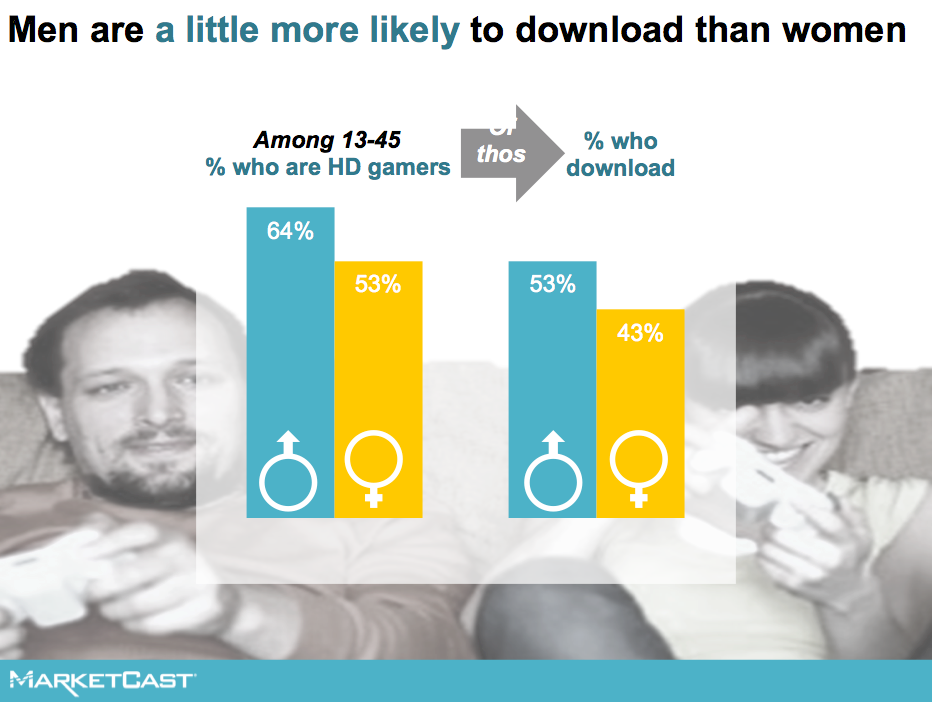

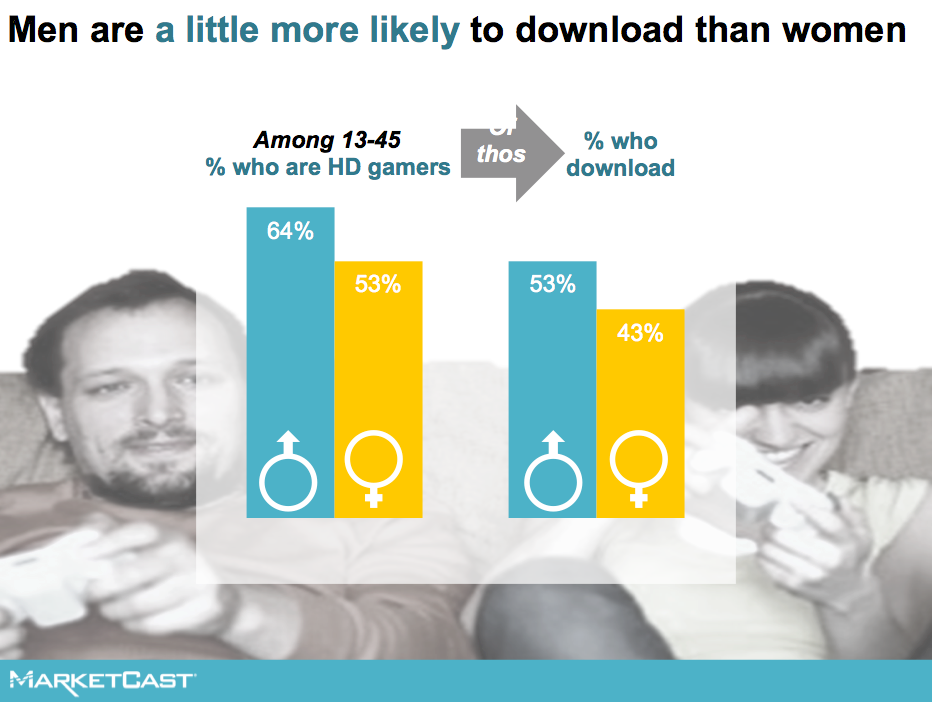

Among HD console owners, men are a bit more likely to download games, but women are not too far behind. The gap between men and women downloaders is fairly similar to the gap between men and women gamers overall.

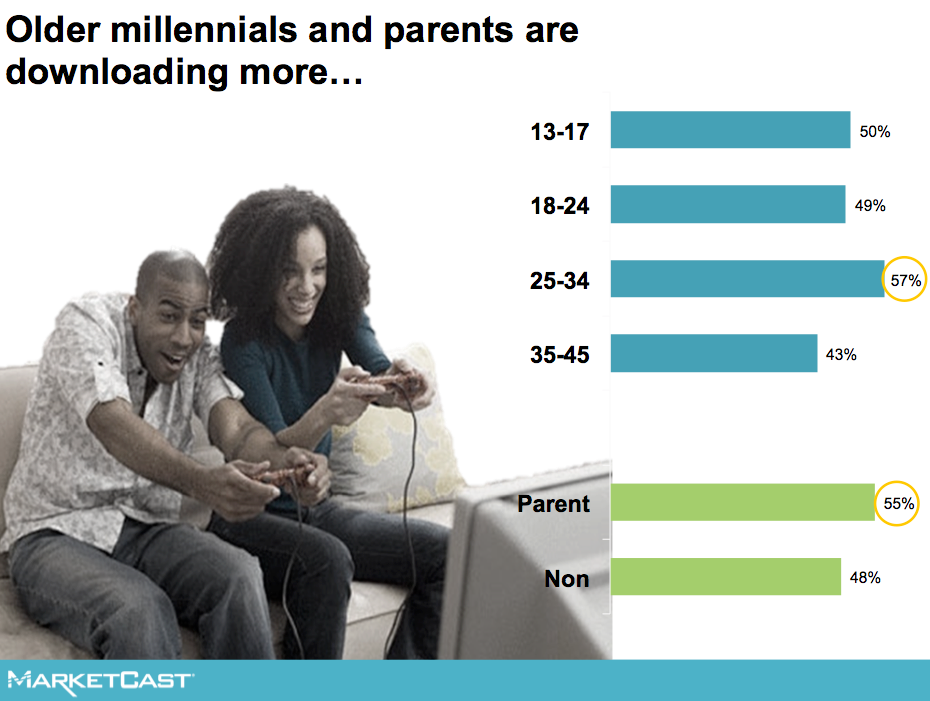

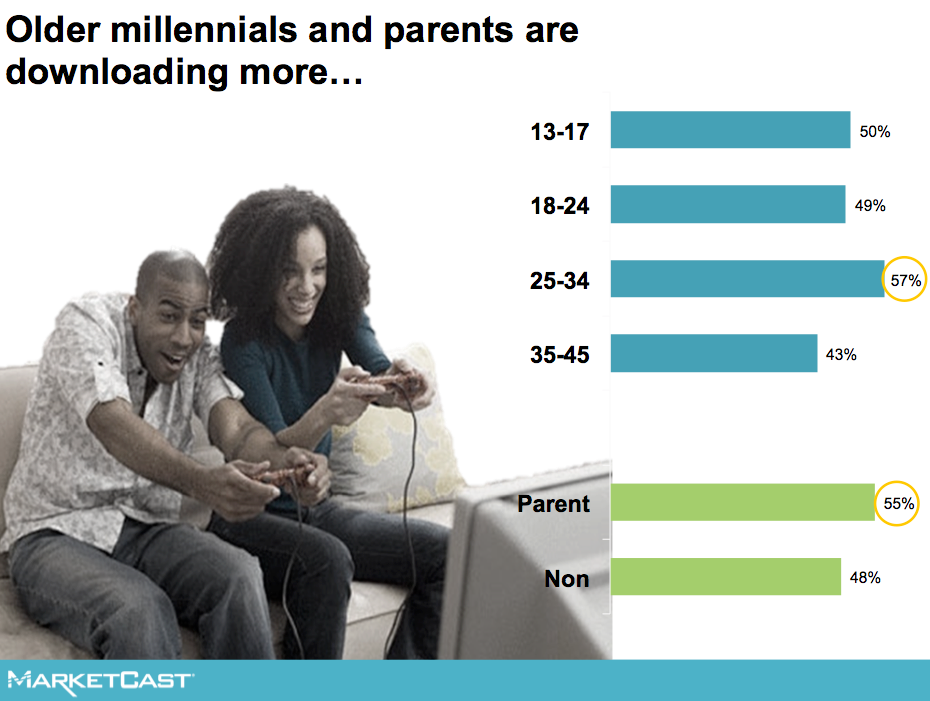

And, although teens might be hooked on digital-everything, older millennials and parents are actually more likely to be downloaders.

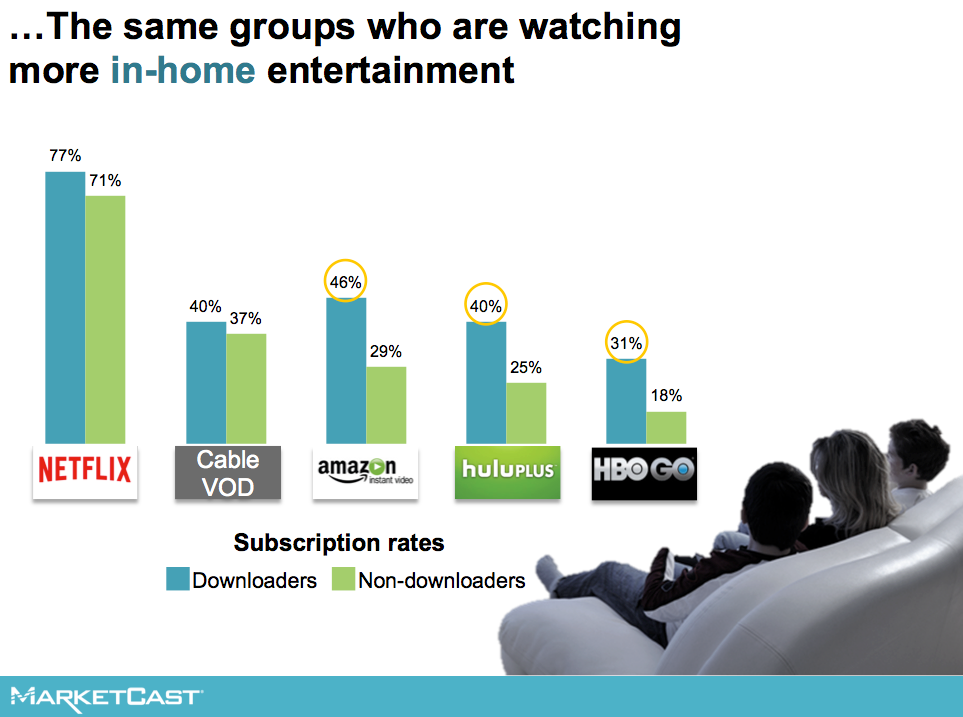

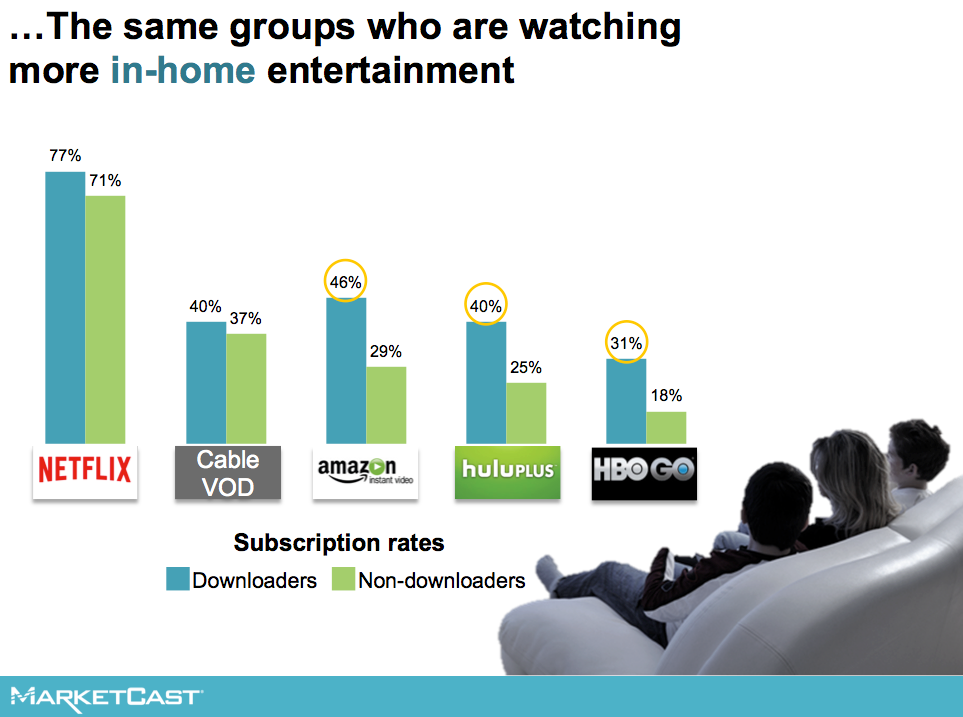

All of these console owners tend to have Netflix subscriptions, and they use their cable’s video on demand about equally. But downloaders – along with older millennials and parents – are big on spending their entertainment dollars at home, so not only are they buying games digitally, they’re also subscribing to more digital platforms like Amazon, Hulu, and HBO Go.

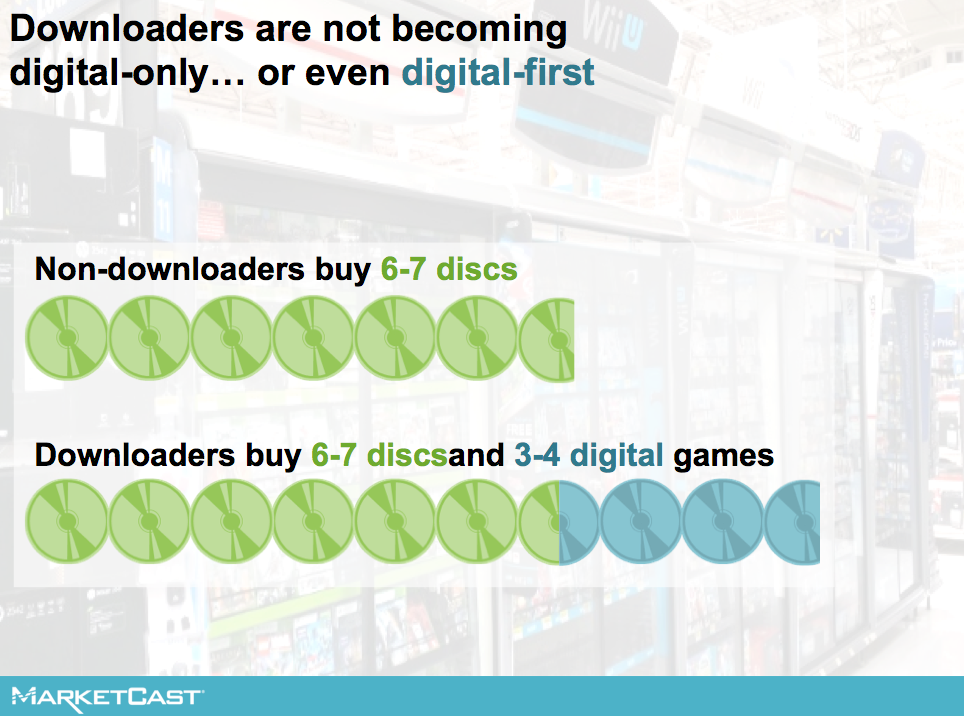

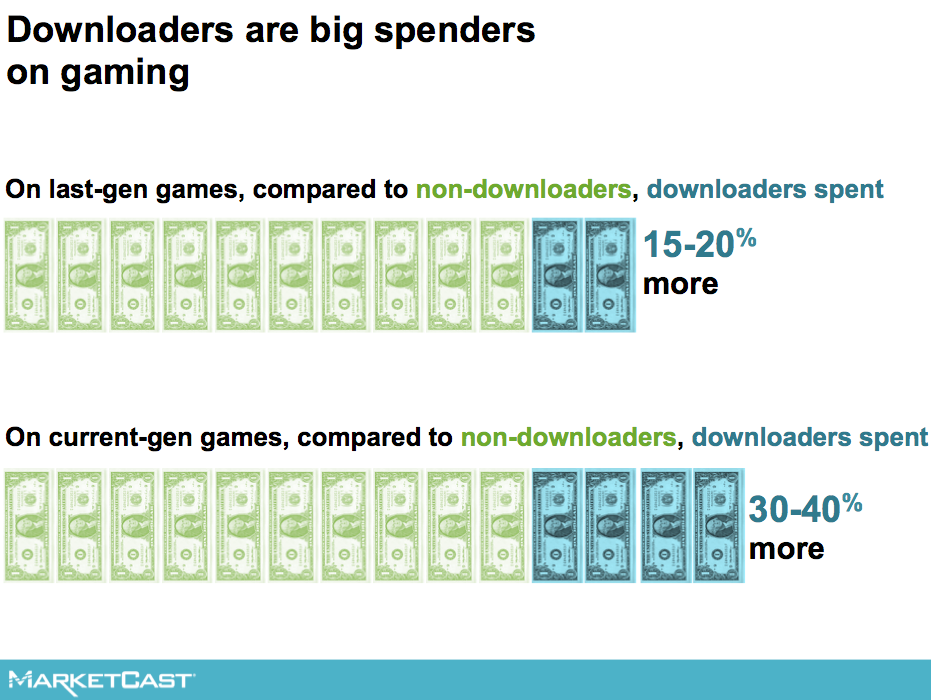

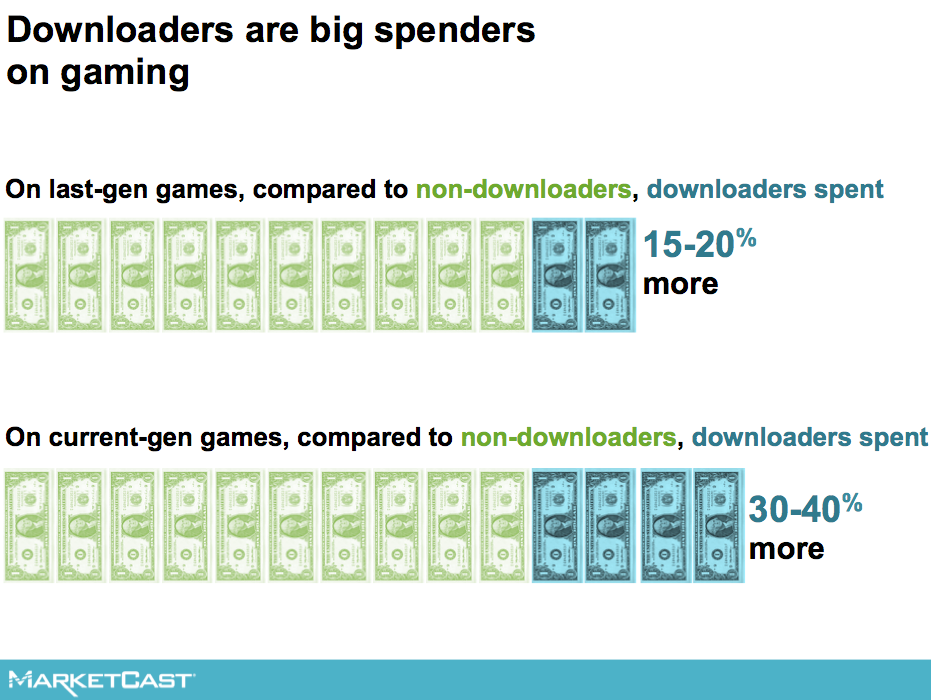

Compared to non-downloaders, gamers who buy games digitally spend 15-20% more on last-gen games for the Xbox 360 and PlayStation 3 overall. And they spend 30-40% more on games for current gen consoles.

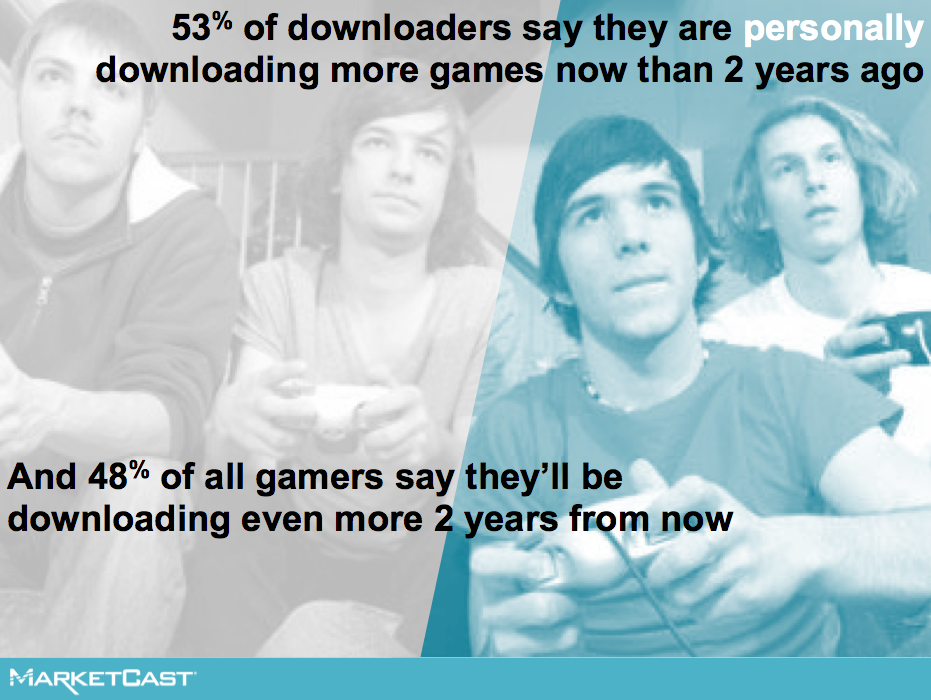

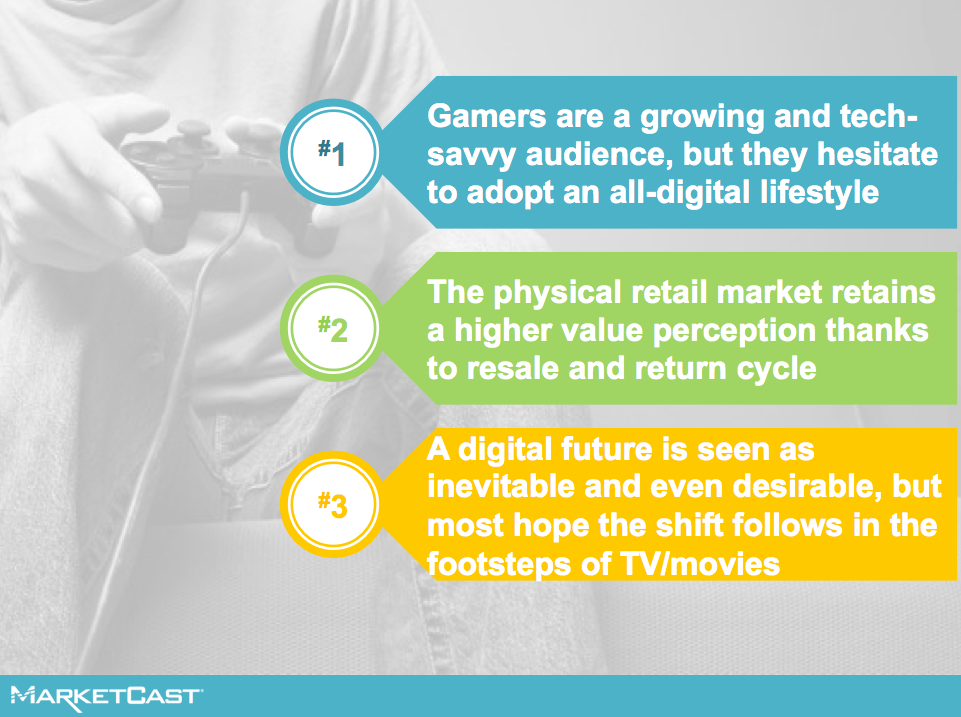

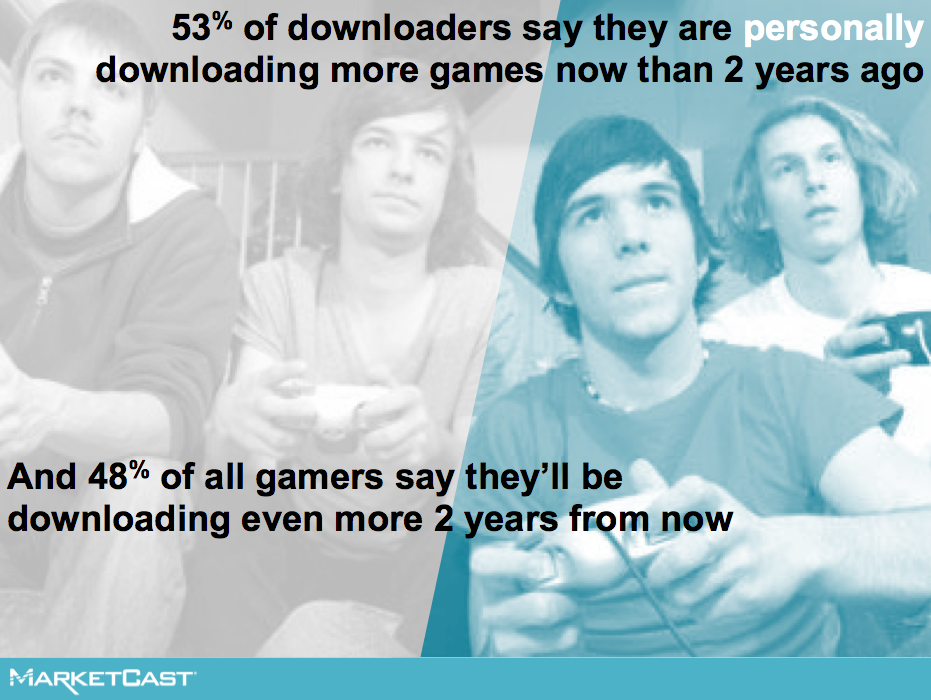

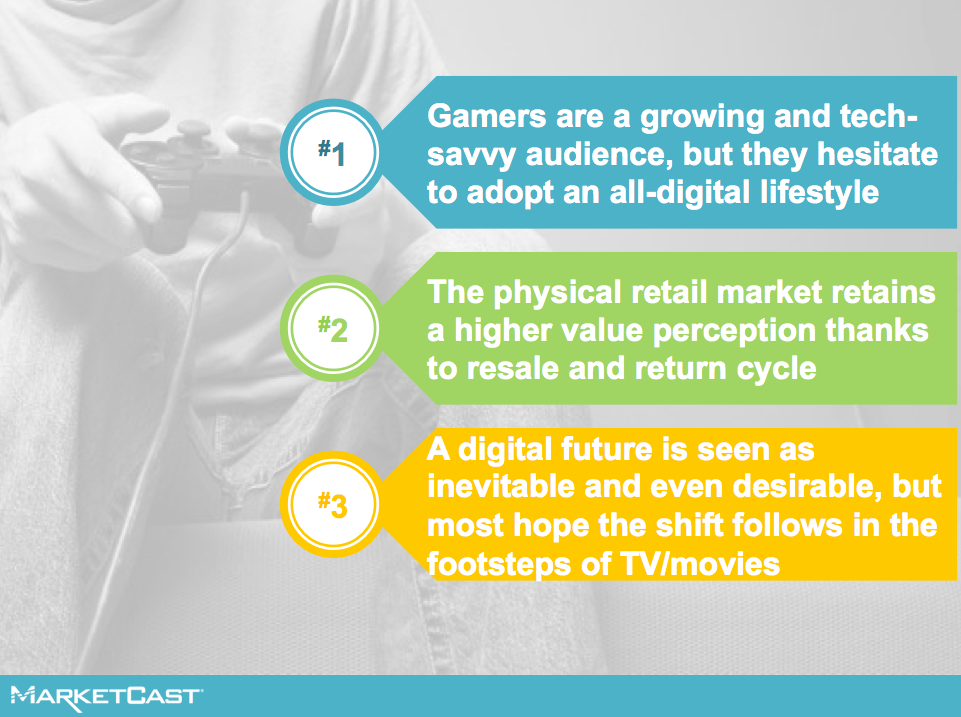

Even though most still prefer physical copies, gamers admit that they’re personally driving this shift toward digital forward. Almost no one says that they expect to be downloading FEWER games in the future.

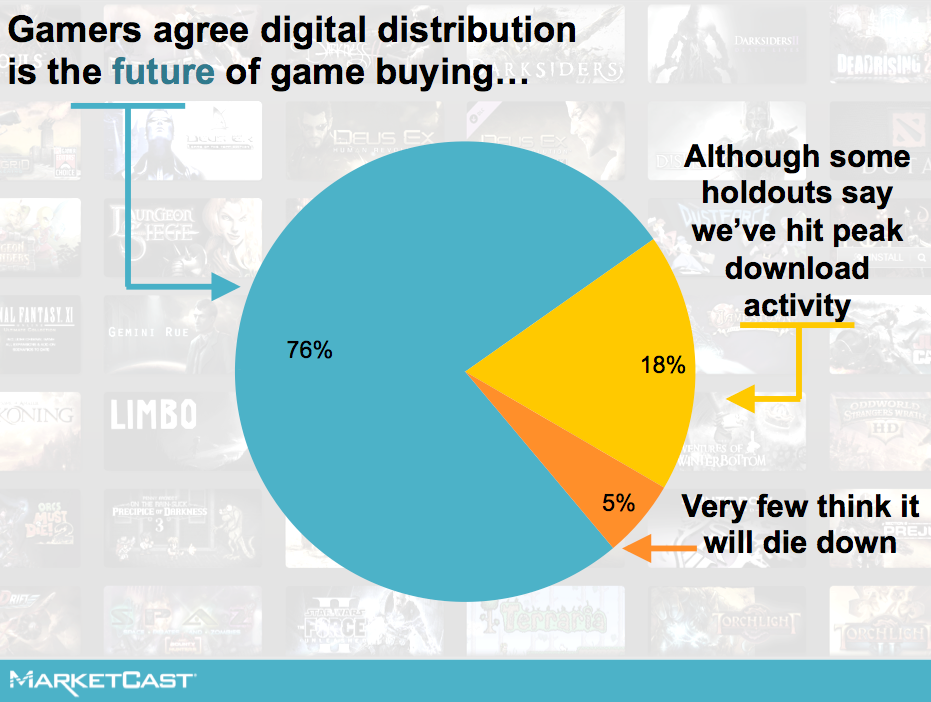

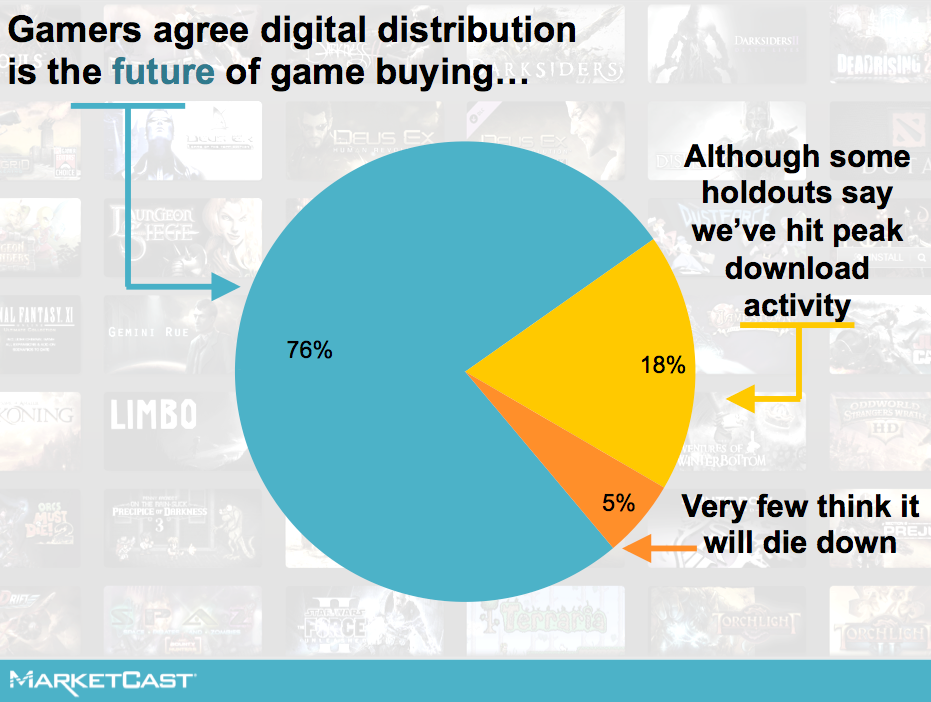

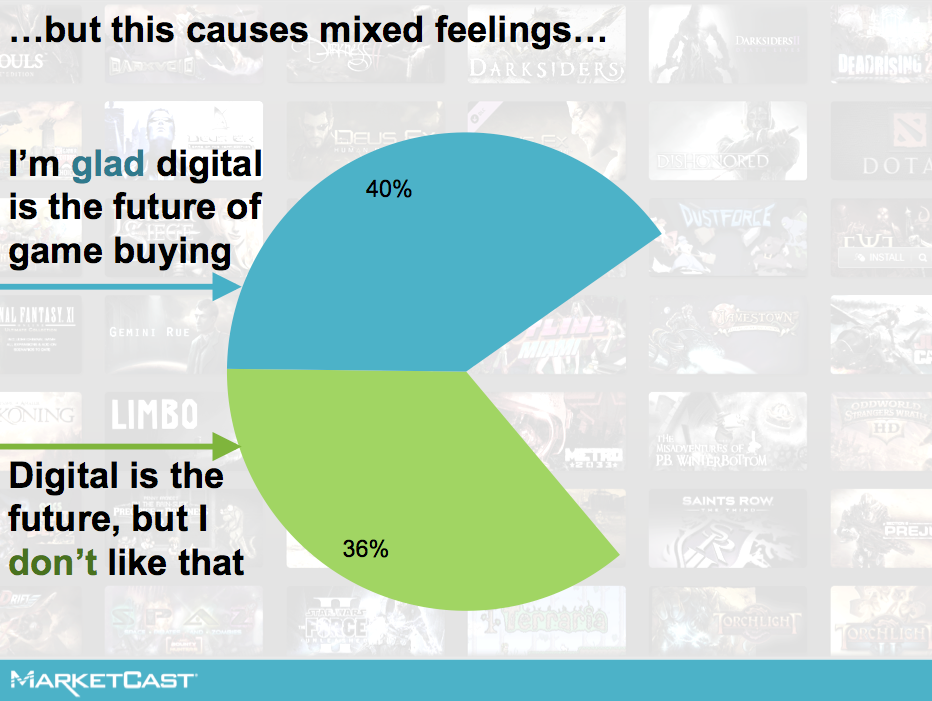

A majority of both downloaders and non-downloaders all agree that digital distribution is the direction that we’re headed in for video game purchasing.

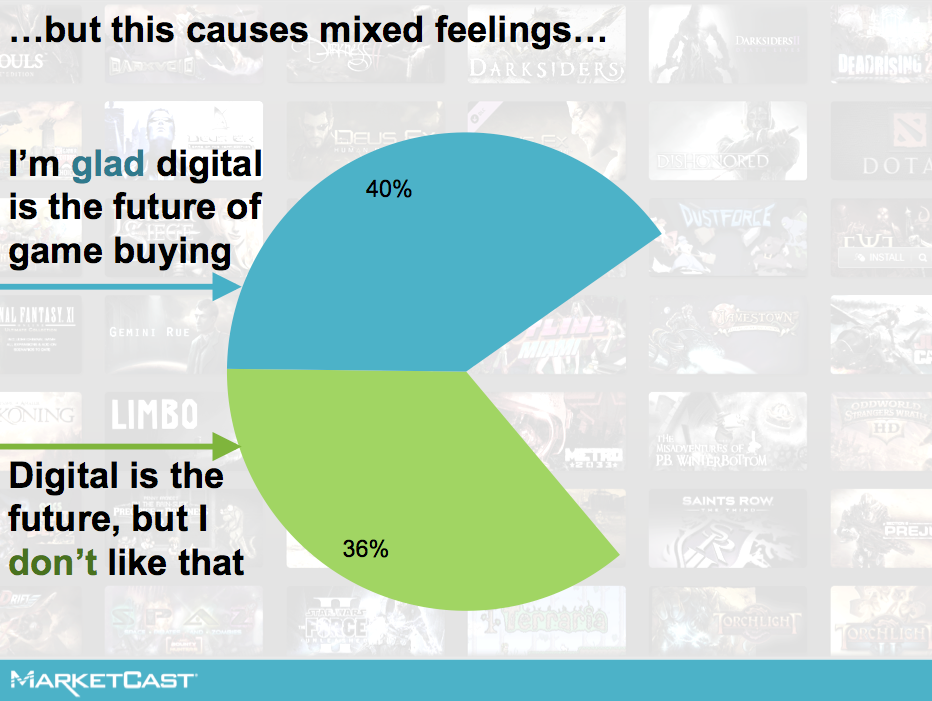

Downloaders are more likely to say they’re pleased that digital downloading is the future of gaming, but even they are not 100% ready. Non-downloaders still mostly think that downloading is the inevitable future, but they’re more likely to say they aren’t happy about that.

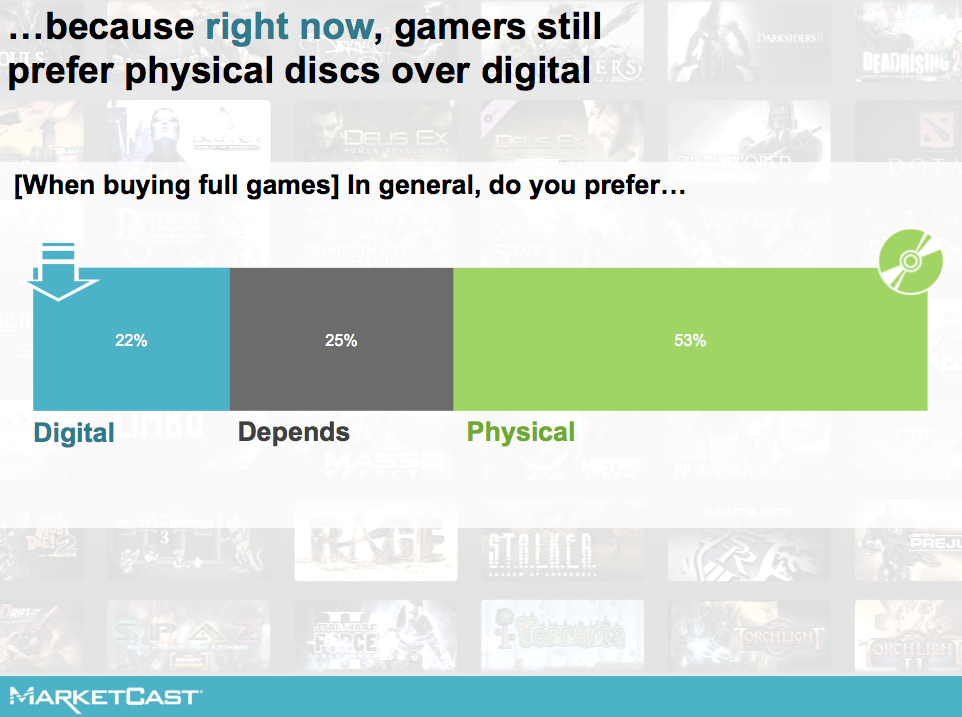

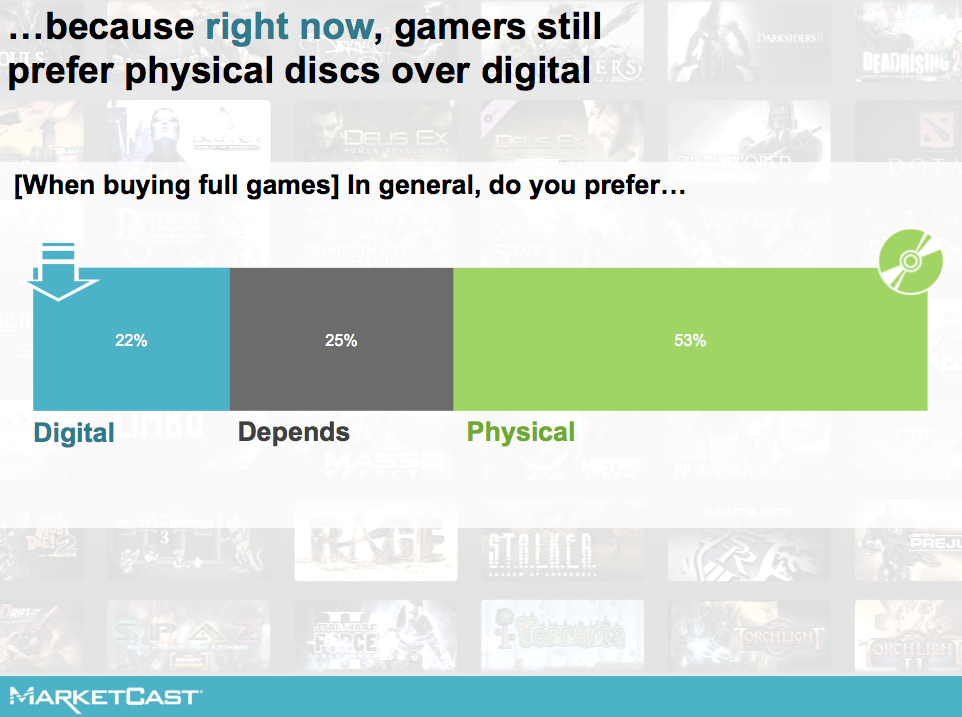

This is true regardless of what group you look at. Males and females, teens and adults all prefer physical copies. So do those who pay to subscribe to premium tiers like Xbox Live Gold and PlayStation Plus. Even downloaders prefer physical copies over digital when it comes down to it.

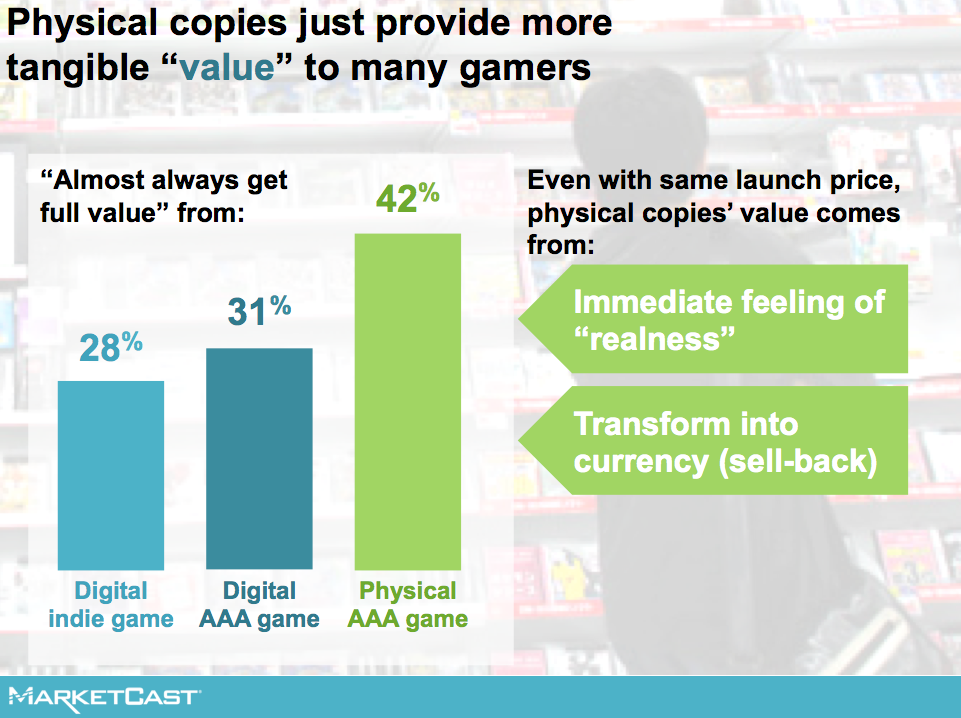

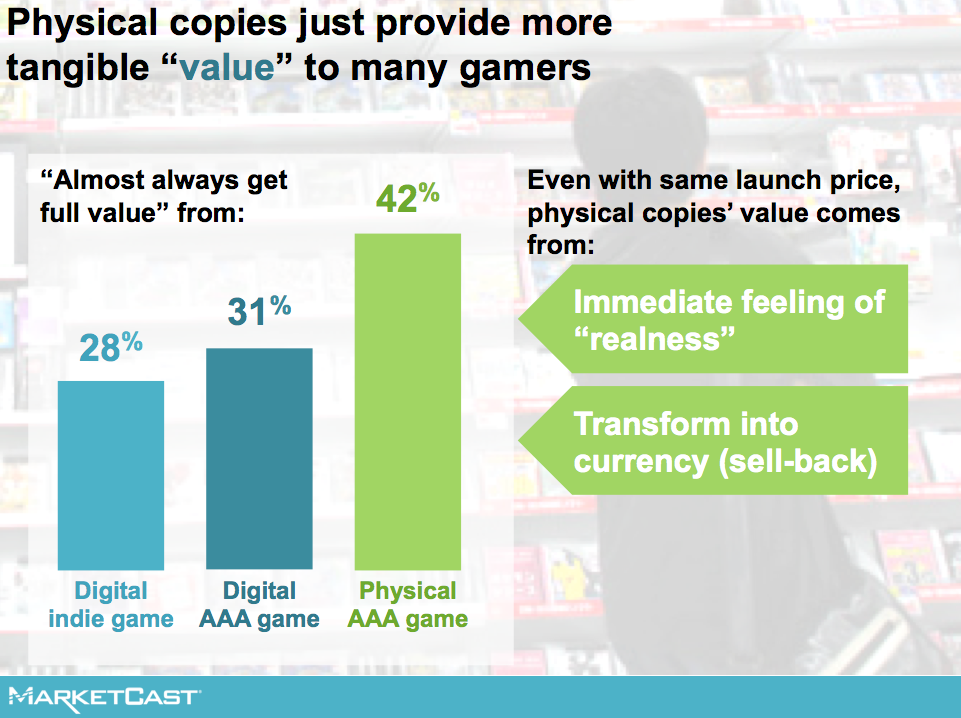

The act of having a physical disc feels more real and as a result tangible value becomes intangible value. Physicality creates a perception of more value; having something tangible is important on its own. But also, down the road, it becomes a form of currency.

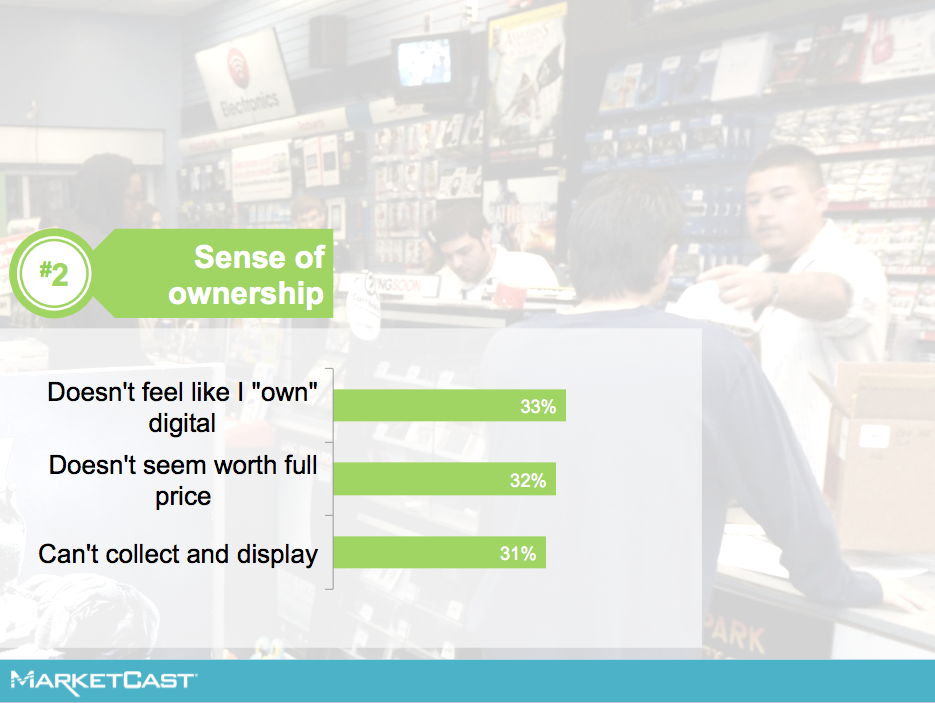

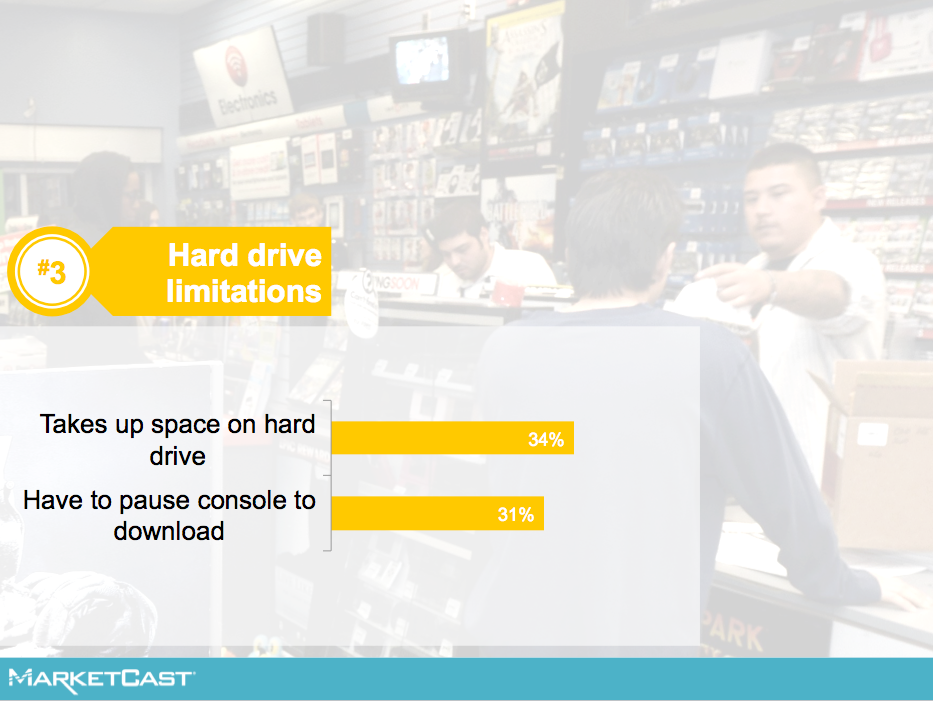

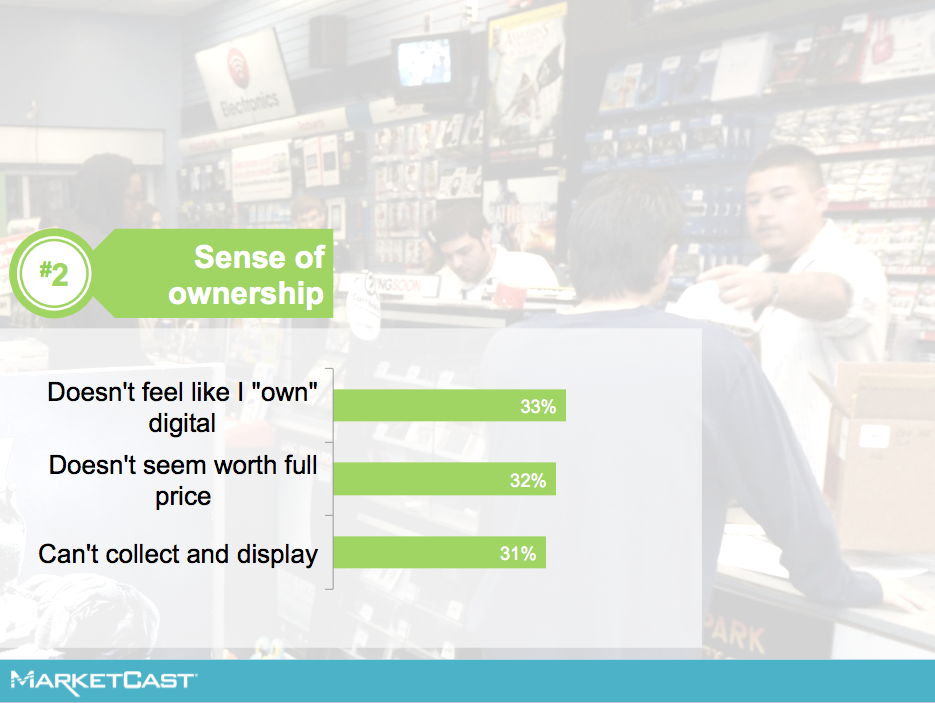

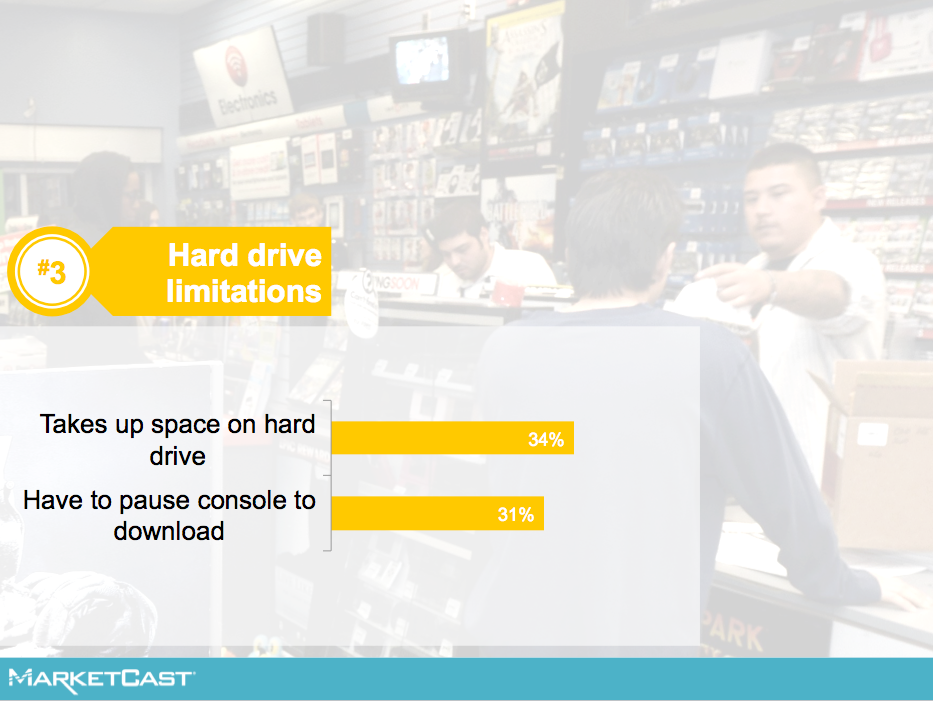

Those two forms of value – the tangible use of games as currency, and the intangible feeling of ownership, make up the main reasons why gamers keep purchasing physical rather than digital. The other side of physical purchasing is mostly made up of a sense of security: people fear that they will be prevented from keeping their purchases because of hard drive space, consoles crashing, or gaming companies changing the rules.

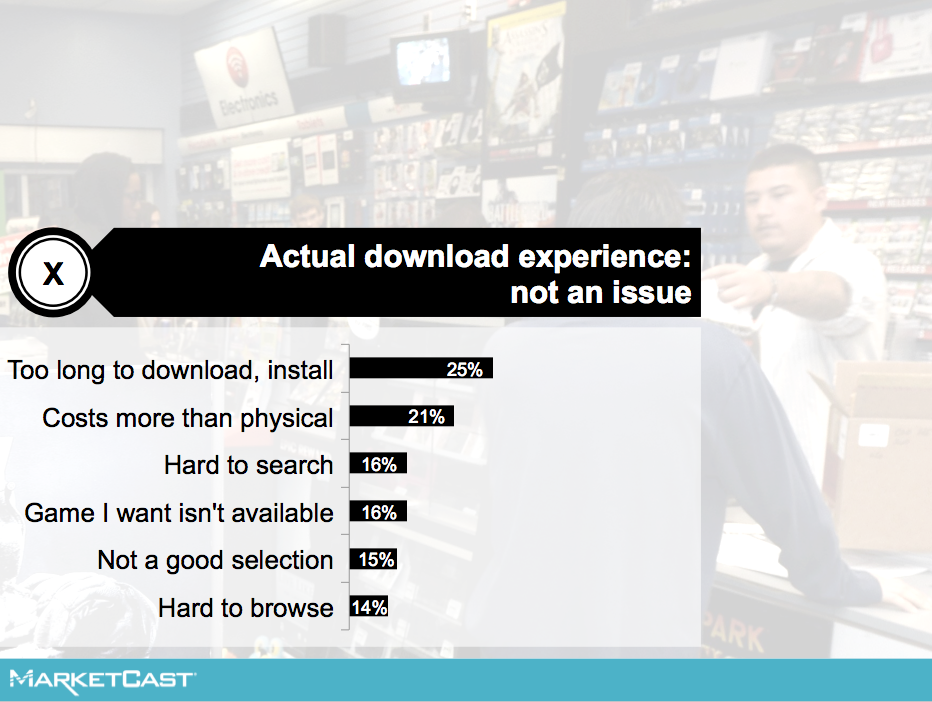

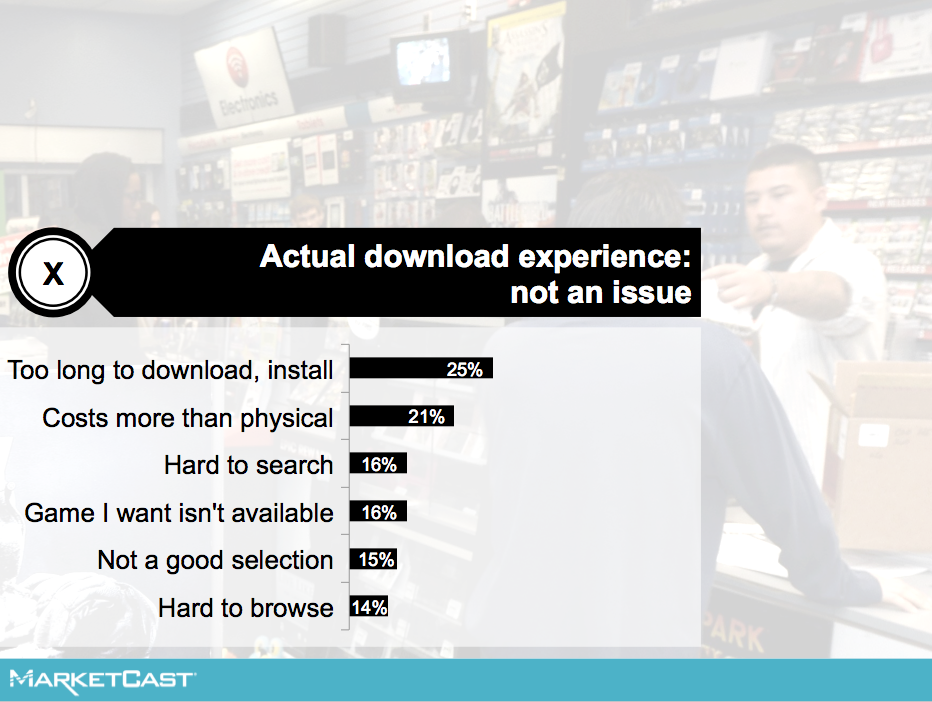

Gamers are actually very satisfied with the functional experience of downloading. Aside from storage space, the tech is not a problem.

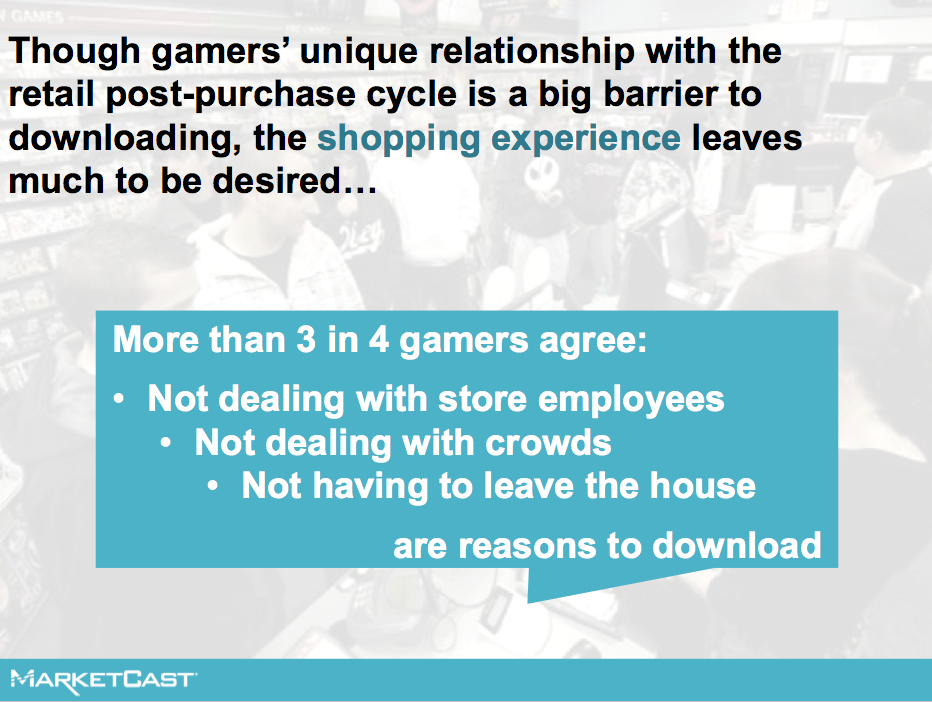

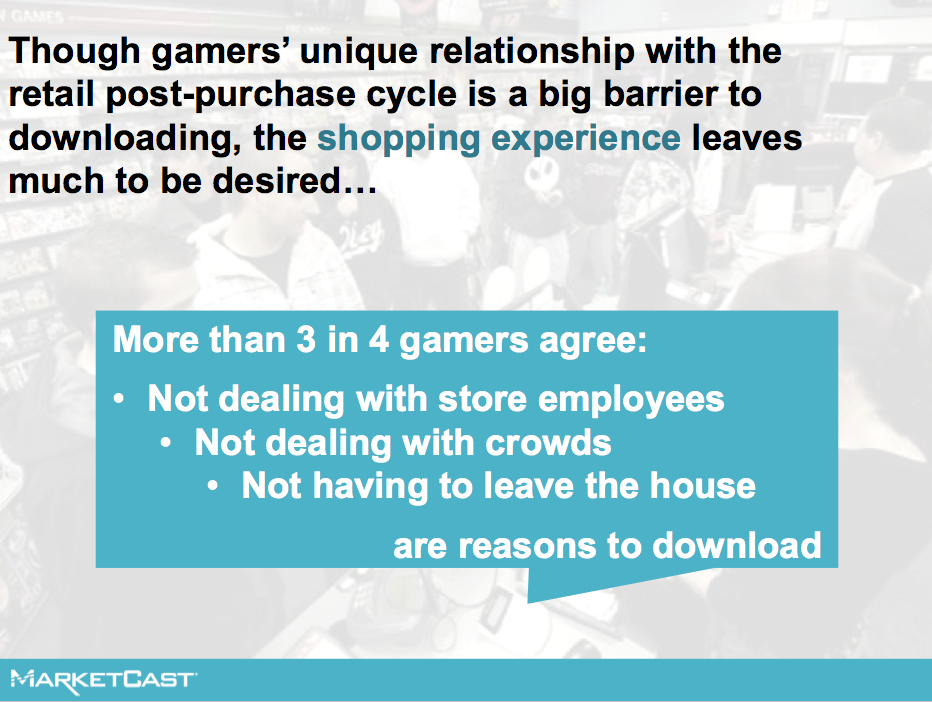

They personally feel that not having to interact with store employees, along with not even having to go to the store, is one of the advantages of downloading over buying physical copies.

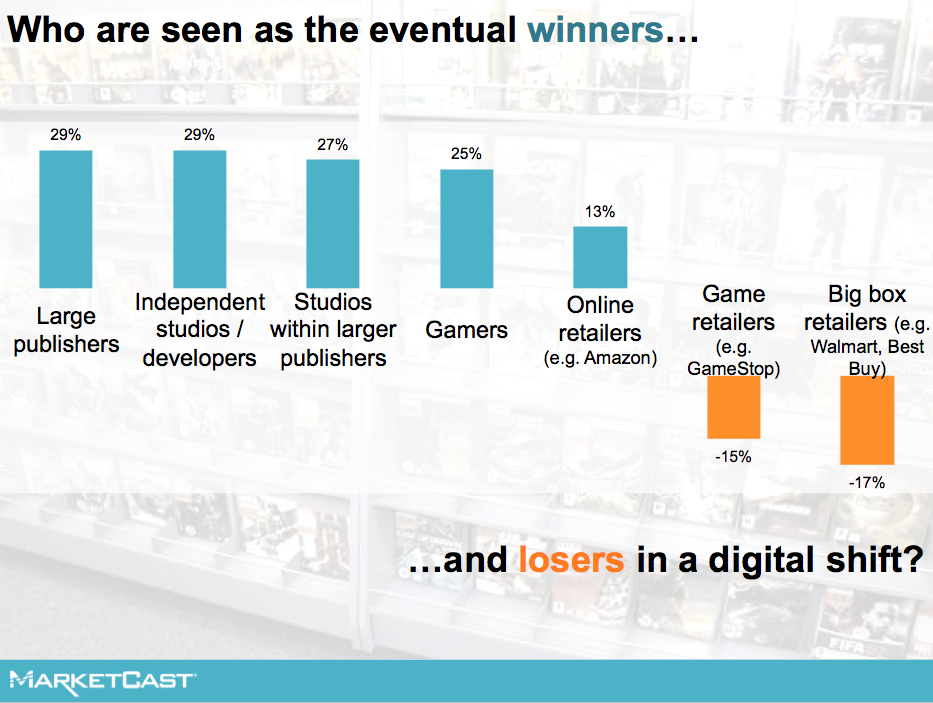

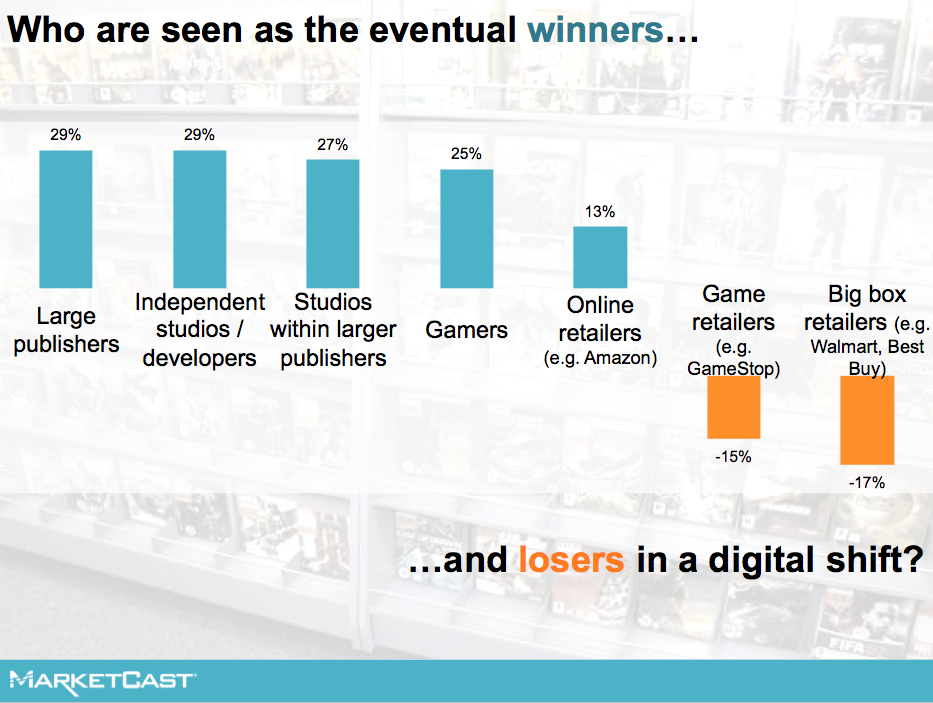

Virtually everyone wins except for the physical retailers. Gamers are optimistic that they will benefit from a digital shift in the long run, and they expect brick-and-mortar stores to be the only ones who really suffer.

In the world of movies, the retailers played a part in encouraging the digital shift along. Big-box stores promoted DVDs and Blu-Rays as loss-leaders, with heavy markdowns and those big boxes of random DVDs to dig through. This helped make the physical product seem less valuable, and consumers placed less premium on owning the discs, which primed the market for a digital shift.

That’s not likely to happen in the gaming world. Games are sold with a comparatively higher volume out of gaming-specialty stores rather than big-box stores, and gaming-specific retailers are unlikely to turn their main product into a loss leader by cutting down the base price.

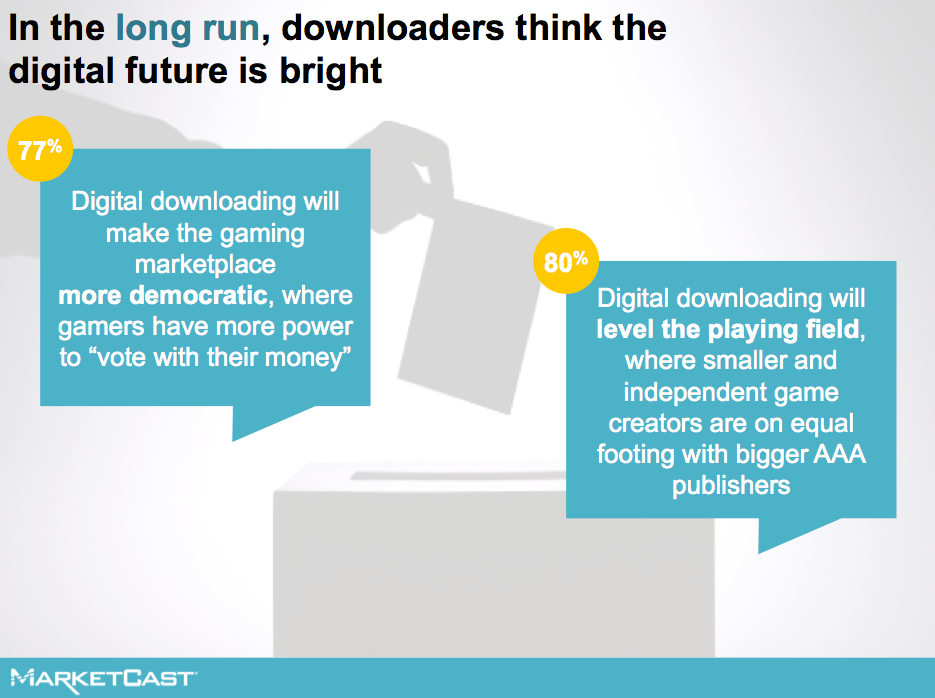

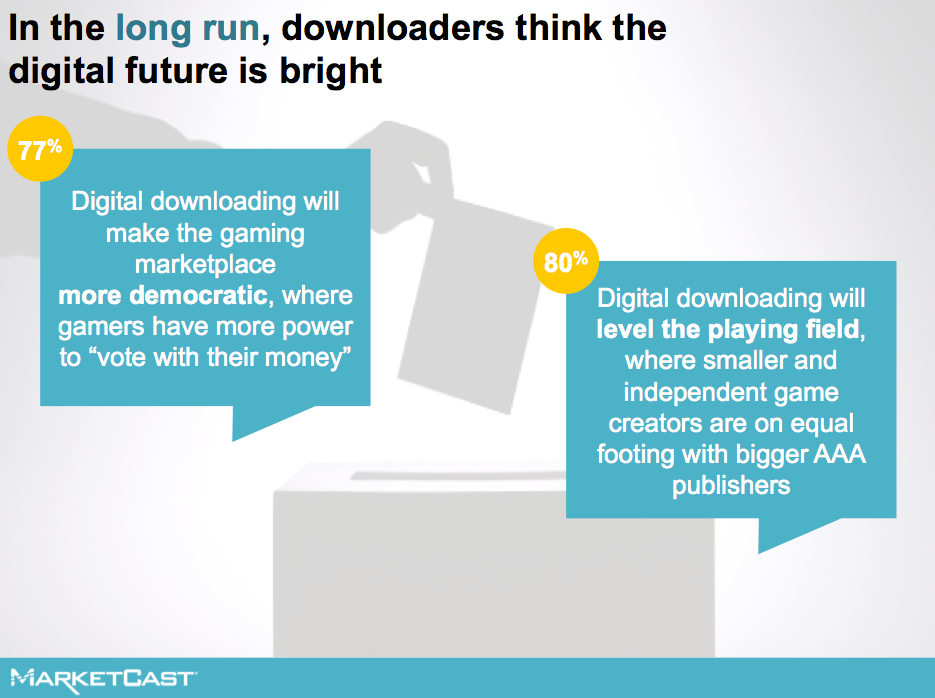

And what do respondents think about the long run for downloading games?

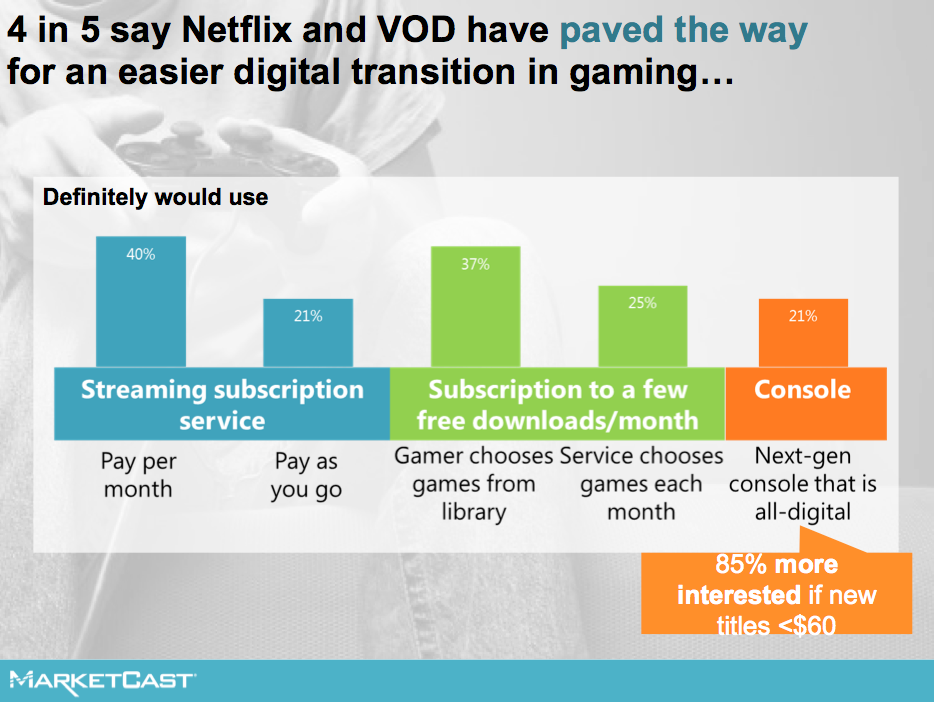

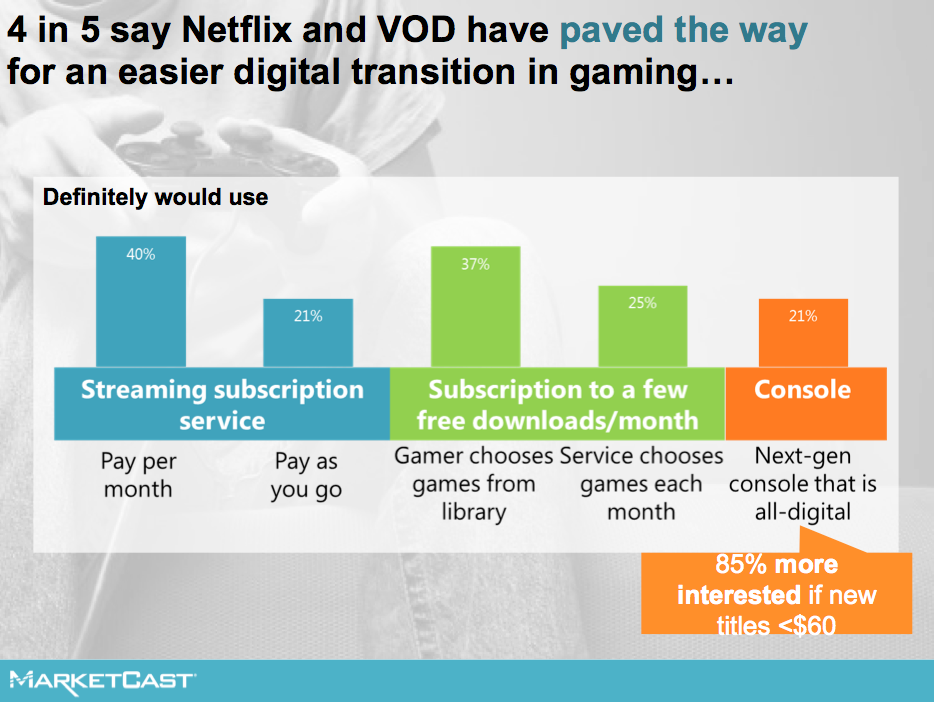

Or, instead of downloading full games, consumers are open to the gaming industry taking a fully different route and following directly after the footsteps of movies and music, to offer something like a streaming service membership. This is still in its infancy, but services like PlayStation Now are trying to redefine digital gaming with streaming possibilities. And gamers are definitely open to that.

In fact, a monthly subscription is more appealing than a future console with all digital downloads… with the exception of one that makes games cost less overall.

While some gamers note that the file size and the need for zero lag will be a hurdle to overcome for streaming games, they like the idea especially because it overcomes the fear of getting stuck with a dud that you can’t return or sell back.

For more information on MFour's mobile solutions, click on the solutions tab at the top, or fill out the form below.

[gravityform id="3" name="Contact Us" description="false"]