When you’re looking for insights into shopper satisfaction, you’re asking for trouble if you rely on panelists to fall back on recall when they tell you about their in-store experiences. Timing truly matters – and a new comparative study suggests that there’s a consistent difference between the truth shoppers tell about their experiences in-the-moment, and what they say after the experience has slipped into the recent past. The good news is that in-the-moment insights are yours for the asking – if you remember to GeoLocate shoppers when their experiences are fresh in mind.

It turns out that waiting to ask about shopper satisfaction will skew your data. That’s one of the takeaways from a comparative study in which 200 GeoLocated consumers took mobile surveys within three hours of a shopping experience. They consistently reported greater satisfaction than those in a similarly-composed control group that was not GeoLocated, and therefore fell back on memories that appeared to tarnish over time.

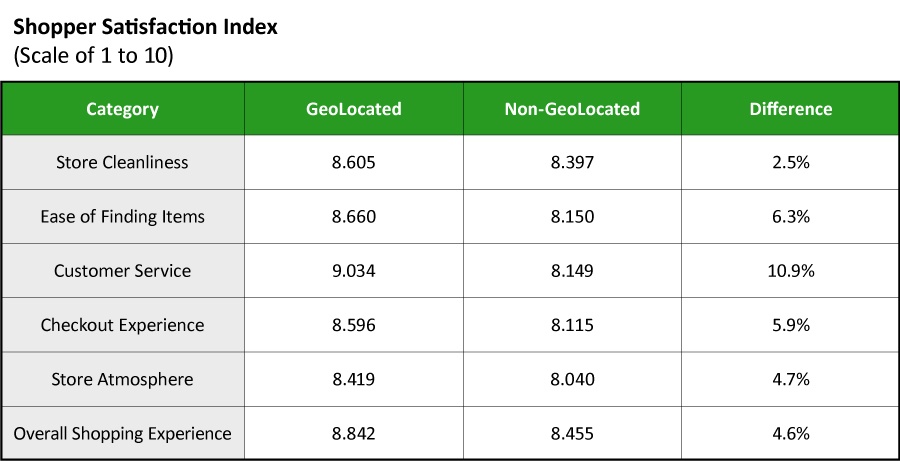

Asked to rate their satisfaction with their most recent shopping experience on a scale from one to ten, the GeoLocated group had an average score of 8.842 – 4.6% higher than the non-GeoLocated group’s score of 8.455.

The pattern held as the questioning grew more specific. Respondents were asked to rate their most recent shopping experiences by five additional measures, and the GeoLocated group that answered with the experiences fresh-in-mind reported greater satisfaction in every category. Here are the results:

Our comparative study suggests new insights into how consumers’ perceived satisfaction erodes over time. Was it a case of not enjoying their purchases as much as they’d expected when they were in the checkout lane? Or does this indicate something broader about consumer perceptions changing over time? In any case, for accurate insights it’s important to probe for the truth as swiftly as possible after consumers have had the experience you’re studying.

In our blog posts earlier this week, we reported marked differences in recall between the two groups in the comparative mobile GeoLocation study. When it came to remembering the product categories in which they’d made purchases, recall was 100% for the GeoLocated group. In the non-GeoLocated control group, only 72% were able to recall product categories from their most recent shopping trip. The same pattern held for brand recall, with non-GeoLocated respondents consistently less able to name the brands they’d bought.

To sum up, timing is of the essence when it comes to getting an accurate picture of how consumers think, act and feel. If you don’t GeoLocate, you’ll get a sketch from memory. But if you use top mobile technology to find respondents in the places most relevant to your research, then follow up with an immediate survey, you’ll get a near-photographic record of shoppers’ reality. Sketches give you an impression; photo-realism tells you what is. Which do you think lays a better basis for making good business decisions?

So try in-location or after-visit mobile GeoLocation surveys to get to know your customers better. No other methodology can bring you this close to the Point of Emotion® – the moment when shoppers make their buying decisions. For full details – and an unforgettable research experience – contact us at sales@mfour.com.