It’s often said that memories make life worth living. But in consumer insights, too often they make life a headache.

Yes, we’re talking about recall bias, which is the error that occurs when survey respondents give answers based on faulty recall. It’s a harsh reality that while memories are made to be cherished, the reason we cherish them is because they are so easily lost. And in market research, data infected by recall bias compromises everything.

As the authors of a 2017 scholarly study examining recall bias put it, “simple…recall questions generate large measurement errors.” The study focused on a survey by the Canadian government in which respondents were asked how much they had spent on food over the previous four weeks. The answers consistently underestimated actual expenditures, compared to data from subsequent diary studies involving the very same respondents (the authors noted that the diary phase was considered more reliable, but had accuracy problems of its own because of data-distorting factors such as respondents growing tired of having to record expenses each day).

The good news is there’s now an almost surefire remedy for recall bias in consumer research. But first, let’s dig a bit deeper into the problem, by asking you to take a very quick survey.

- How often have you eaten quick-serve restaurant food in the past two weeks?

- How many times have you stopped for gas over the past four weeks?

- When did you last pass by a billboard for [fill in the name of the brand or product]?

- Do you like being asked questions you can’t properly answer?

That last one is rhetorical and perhaps a bit facetious. But the fact is, recall-based research happens all the time, and it puts insights professionals in the uncomfortable position of having to present recommendations to decision-makers that the researchers know are tainted by recall bias. Until now there has been no reliable and affordable alternative, except to accept recall bias as a fact of life and hope it doesn't distort data too badly.

But now there is.

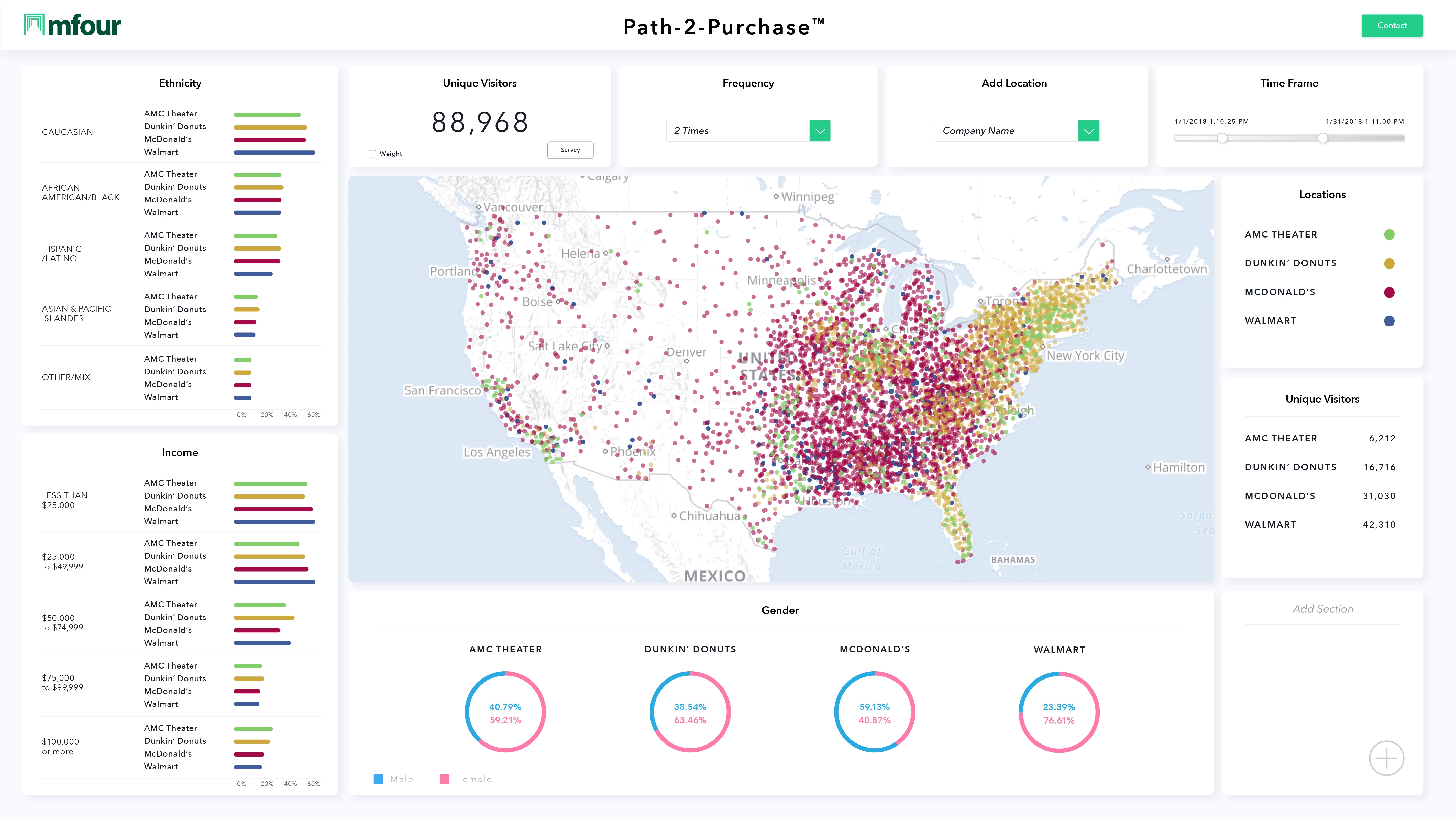

Users of the new Path-2-Purchase™ Platform are putting recall bias behind them. They’re targeting mobile consumers by leveraging smartphones’ GPS features to find real people in real time and in the most relevant places, for in-the-moment, Point-of-Emotion® research. Instead of asking about experiences from a week ago, they’re getting insights into what their consumers just did – or are doing right now – along with vivid and trustworthy feedback on why they’re doing it and how it makes them feel.

It’s also important to note that with Path-2-Purchase™ you don’t have to even ask a question to learn how many times a consumer has been to a gas station or a quick serve restaurant over the past two or four weeks. Respondents opt in for location tracking that automatically tells you where, when, how often and for how long they’ve been in a given location. You can use that information to build a perfectly-tailored questionnaire. You also can track whether they’ve come in view of your brand’s billboards.

Early adopters of Path-2-Purchase™ Platform are beating recall bias at last, and so will you. For a one-on-one demo of how it can fill your projects' specific needs, just click here.